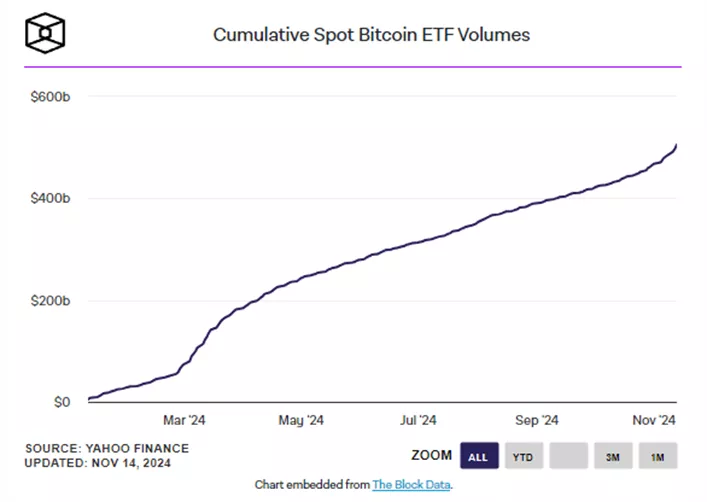

Since the approval of Bitcoin ETFs in January, trading volumes have reached $505.4 billion as of November 13, according to The Block.

“Trading volume for BlackRock’s IBIT surpassed $5 billion for the first time in history. It’s one of the most actively traded ETF products on the market. Over three days, IBIT trading volume reached $13 billion, setting a record,” Bloomberg analyst Eric Balchunas noted.

Milestones in BTC-ETF Trading

By March, BTC-ETF trading volume had exceeded $100 billion, and by April, it reached $200 billion when Bitcoin hit its all-time high of $74,000. Growth slowed thereafter, with Bitcoin consolidating in the $50,000–$70,000 range for several months.

Market activity picked up following the victory of pro-crypto candidate Donald Trump in the U.S. presidential election, reigniting interest in IBIT and similar instruments.

“On November 13, IBIT trading volume set a new record at $5.37 billion,” The Block reported. Total trading volume across all Bitcoin ETFs on that day was $8.07 billion.

Capital Inflows and AUM

- Total capital inflow since launch: $28.2 billion, including $4.7 billion after Trump’s victory.

- Assets Under Management (AUM): $95.4 billion, with $42.6 billion attributed to IBIT.

“IBIT surpassed $40 billion in AUM in just 211 days, breaking the previous record held by IEMG,” Balchunas added.

Forecasts and Upcoming Launches

Daniel Chung, co-founder of Syncracy Capital, predicted the launch of a SOL-ETF in Q1 2025, following Trump’s election victory.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.