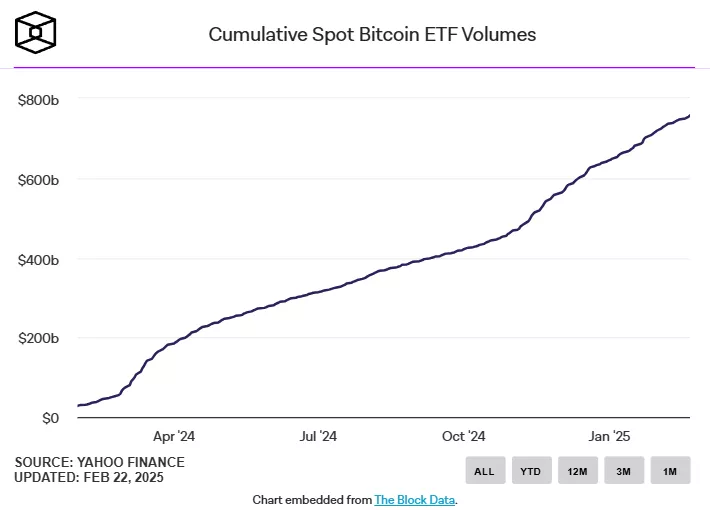

Just over a year after their debut in the U.S., the cumulative trading volume of spot Bitcoin ETFs has exceeded $750 billion.

In comparison, Ethereum-based ETFs have recorded a much lower volume—$56.15 billion as of February 21.

BlackRock’s IBIT accounts for 75% of the total Bitcoin ETF volume, a significant increase from its initial 25% share.

Total assets under management (AUM) for Bitcoin ETFs now exceed $110 billion, according to SoSoValue, with IBIT alone managing approximately $56 billion.

However, worsening market conditions and declining investor sentiment have led to negative trends in the sector. According to The Block, net outflows from ETFs reached $886 million this month.

Earlier, institutional investors allocated $38.7 billion to Bitcoin ETFs in Q4.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.