Bitcoin can be viewed as a hedge against tariff-related risks amid rising U.S. isolationism, according to Geoffrey Kendrick, Head of Digital Assets Research at Standard Chartered, The Block reports.

Markets plunged following U.S. President Donald Trump’s declaration of April 3 as “Liberation Day.”

Kendrick believes the downturn is temporary and expects Bitcoin to return to the $84,000 level — unless traditional markets experience a major decline.

“U.S. isolationism is akin to elevated fiat risks, which ultimately benefits Bitcoin,” Kendrick stated.

He identified $76,500 as a key support level — the top of the daily candle from November 6, 2024, a day after the U.S. elections.

Kendrick acknowledged the market correction but emphasized that Bitcoin continues to outperform key tech stocks, including those in the Mag 7 index, trailing only Microsoft and Google.

The Mag 7 includes stocks from the so-called “Magnificent Seven” tech giants: Apple, Microsoft, Nvidia, Amazon, Alphabet, Meta, and Tesla.

The analyst urged investors to consider Bitcoin not only as a hedge against U.S. isolationism but also more specifically as protection against trade-related tariffs.

Federal Reserve Rate Outlook

Bob Michele, JPMorgan’s Head of Fixed Income, told Bloomberg he believes the Fed is likely to cut rates — despite Chair Jerome Powell’s cautious remarks.

Powell has stated the central bank will carefully observe the effects of tariff policies before making any decisions.

Michele compared the current drop in equity indices to previous crises in 1987, 2008, and 2020 — all of which prompted the Fed to shift toward emergency monetary easing.

On March 7 at 6:30 p.m. (MSK/Kyiv), the Federal Reserve is set to hold an unscheduled meeting.

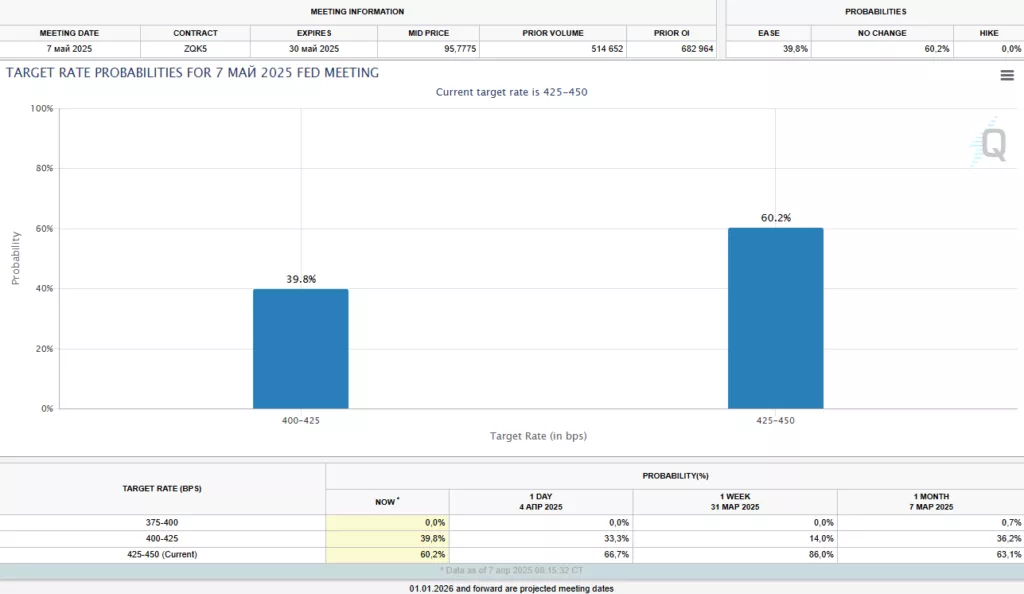

According to the CME FedWatch Tool, 60.2% of traders believe the Fed will maintain the current rate at its next meeting on May 7, while 39.8% expect a 25 basis point cut.

At the time of writing, Bitcoin is trading at $77,351, down 6.4% over the past 24 hours, according to CoinGecko.

Meanwhile, CoinShares reported that from March 29 to April 4, crypto investment fund clients withdrew $240 million — a reversal following the previous week’s $226 million inflow.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.