Strategy has reported $5.91 billion in unrealized losses for the first quarter of 2025, citing the decline in Bitcoin’s price amid a challenging macroeconomic backdrop.

Between January and March, the company acquired 80,715 BTC for a total of $7.66 billion. The average purchase price was $94,922, while Bitcoin was trading below $84,000 at the end of the quarter.

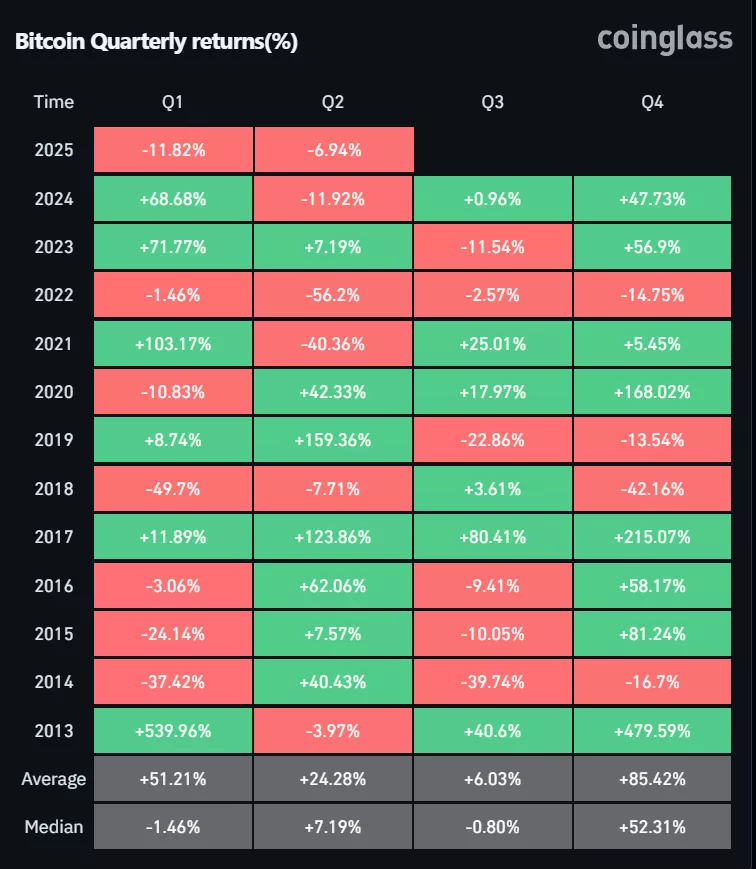

During the same period, the cryptocurrency dropped by 11.82% — its worst quarterly performance since 2018, according to Coinglass.

Strategy has not made any additional Bitcoin purchases since March 31.

As of April 7, the firm holds 528,185 BTC. The total value of its reserves exceeds $43 billion, accounting for nearly 3% of Bitcoin’s circulating supply.

In the previous quarter, Strategy added 22,048 BTC at a cost of $1.9 billion.

The decline in asset value also followed a broader market drop triggered by U.S. President Donald Trump’s announcement of new “liberation tariffs.”

Shares of Strategy (MSTR) dropped over 8% in premarket trading, according to TradingView.

Earlier, analysts at Standard Chartered called Bitcoin a potential hedge against tariff-related risks amid growing U.S. economic isolation.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.