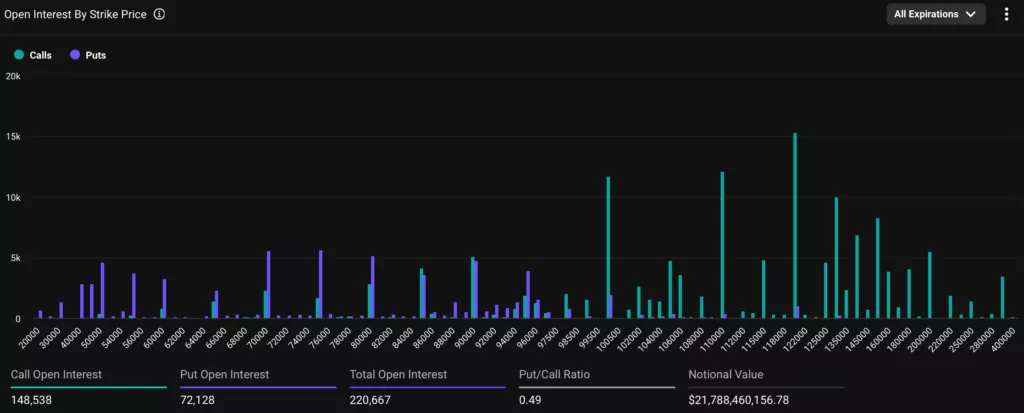

Bitcoin’s price appears to be regaining “bullish momentum,” as evidenced by an increase in options activity with strikes ranging from $110,000 to $120,000, according to data from Deribit and Amberdata.

The main focus among traders is on call options with a strike price of $120,000. The total nominal open interest in these contracts has reached $1.52 billion.

Call-Put Ratio Signals Bullish Sentiment

For all expiries on Deribit, the put-to-call ratio has dropped to 0.24—indicating a clear bias toward bullish positions in the options market.

A report from Amberdata notes that the upcoming inauguration of Donald Trump on January 20 could serve as a major catalyst for market growth.

High-Value Call Purchases

According to analysts, on Saturday, a trader on Deribit spent over $6 million to purchase call options at a $100,000 strike price, expiring on March 28. This move suggests they expect Bitcoin to return to “six-digit territory” soon.

BTC Options Trade Worth Over > $6M 💰

— Amberdata (@Amberdataio) January 3, 2025

A trader spent over $6,000,000 on March 28, 2025, 100k calls!

This trade anticipates that new highs for Bitcoin will be broken just a few months after Trump officially takes office.

Source: AD Derivatives @genesisvol… pic.twitter.com/OPL6b7bxNp

“Judging by this bet, the trader anticipates that new all-time highs for the leading cryptocurrency might be achieved just a few months after Trump officially takes office,” the researchers stated.

Futures Market Also Shows Strength

The futures market is likewise signaling a potentially sturdy environment. Coinglass data reveals that funding rates for Bitcoin and Ethereum longs hover around ~10% annually.

“These metrics imply a stable setting with room for the market to keep growing,” Ryan Li, Chief Analyst at Bitget Research, told The Block.

He added that improving liquidity remains a key factor, reflected in part by the revival of stablecoin market cap, which has surged by $3 billion over the past week. Li pointed out that increased institutional activity is one of the main drivers behind this metric’s growth.

Context

- Arthur Hayes, former CEO of BitMEX, has warned of a “painful crash” for Bitcoin around the time of Trump’s inauguration.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.