The UK’s Financial Conduct Authority (FCA) has proposed restricting public offerings of cryptoassets outside specialized trading platforms.

Clear admissions, disclosures and market abuse rules will help improve the integrity of our crypto markets, while protecting people and supporting the UK's growth and competitiveness.

— Financial Conduct Authority (@TheFCA) December 16, 2024

Find out more https://t.co/zB3e0xXkti#crypto #CryptoRegulation #FinancialRegulation

The ban would allow exceptions, such as offerings through trading platforms or limited sales to qualified investors.

Permitted offerings would need to comply with reporting standards. The FCA suggests requiring exchanges to independently verify the accuracy of information provided by asset issuers. For sales to qualified investors, the necessary disclosures would have to be shared with all buyers.

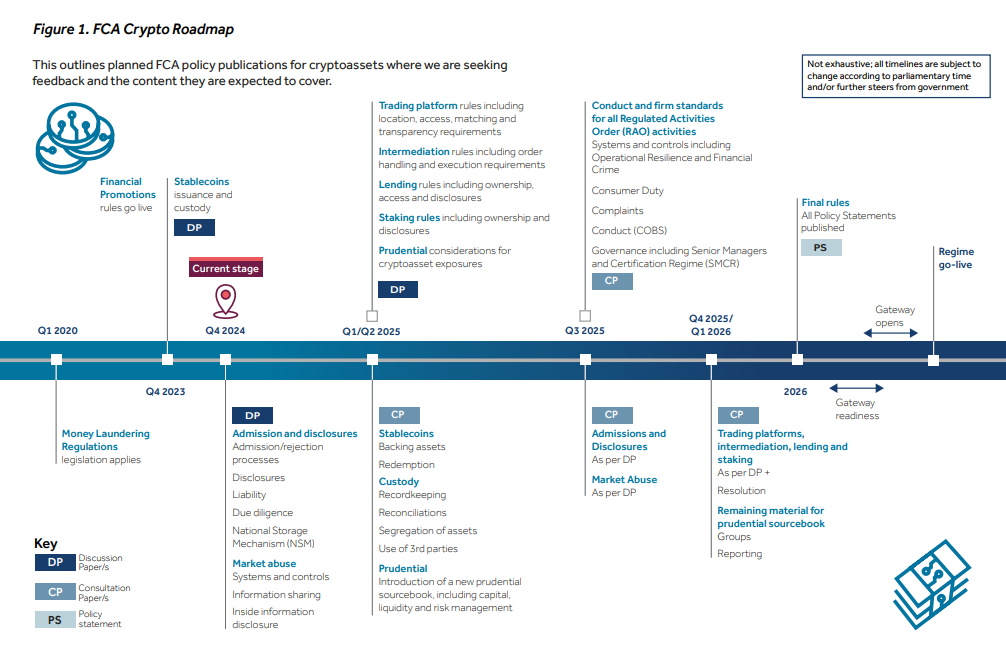

The FCA is collecting feedback from industry participants on this and other aspects of the proposed regulatory framework for the UK. According to the regulator, the new laws are expected to be drafted by 2026.

Comments on this set of proposals will be accepted until March 14, 2025.

“The discussion paper reflects ideas developed during a series of crypto-focused roundtables led by the FCA earlier this year with industry participants,” the authors noted.

In the first half of 2025, regulators plan to explore and discuss rules for stablecoins, DeFi, and custodial services with the industry.

Background: On December 12, UK financial regulators requested data from supervised companies regarding their current and future investments in cryptoassets.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.