Optimism in the cryptocurrency market, known as Uptober, has waned at the beginning of the month. According to Santiment, mentions of Uptober decreased amid a market correction. According to CoinGecko, the total market capitalization fell by $210 billion or about 8%. Bitcoin lost 4.7%, dropping from $64,000 to $61,000.

📉 #Uptober excitement wanes as the market dips, which does open the door for a rebound 🔄 Whether the bigger downtrend is over remains to be seen. What do you think? 🤔 #CryptoInsights #MarketBounce pic.twitter.com/csbRfZu4TN

— Maksim (@balance_ra) October 3, 2024

Historical Dynamics

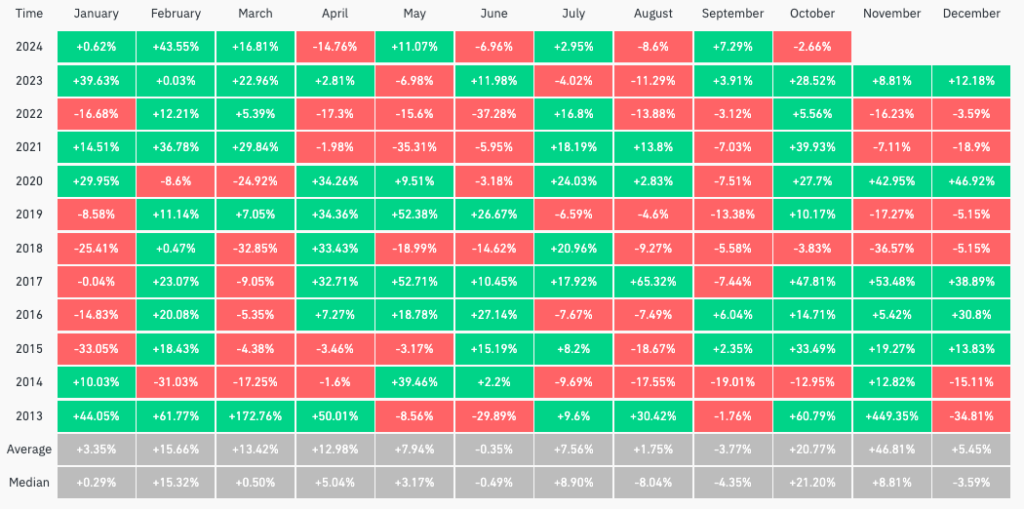

Historically, October has been one of the best months for Bitcoin. Since 2013, in 9 out of 11 years, the price of Bitcoin showed positive dynamics. The average return was 20.74%, making October an important period for investors. However, the positive performance in September, traditionally considered a “bearish” month, raises questions about whether this trend will continue in October.

Macroeconomic and Geopolitical Influences

Andrey Veliky, the founder of Allbridge, points out that the market is facing uncertainty due to regulatory pressure on stablecoins and geopolitical tensions. He also notes that investors are exercising caution in anticipation of changes in legislation in the EU and the USA. According to him, key factors will be the Federal Reserve’s decision on interest rates and the results of the U.S. elections.

“An important event in the near future will be the Federal Reserve’s decision on interest rates, as well as the results of the U.S. elections, which will have a significant long-term impact on the market,” said Veliky.

Trader Artem Zvezdin added that uncertainty related to the U.S. elections and tensions in the Middle East is also restraining market growth. Specifically, the situation with the military conflict in Israel is causing concerns among investors, reducing interest in riskier assets like cryptocurrencies.

“The war in Israel presents geopolitical risks, and as a result, market participants do not want to buy risky assets like cryptocurrency. Once the situation in the Middle East starts stabilizing, it will be a huge positive for the crypto market,” Zvezdin believes.

Zvezdin also noted that a potential victory for Donald Trump in the U.S. elections could bring significant relief for the crypto industry, leading to a positive market reaction. On the other hand, if Kamala Harris wins, there may not be any changes, and the market is likely to remain in a sideways movement.

The trader also suggested that Bitcoin could reach its all-time high by the end of the year and grow to $120,000 by mid-2025.

“The current instability creates uncertainty, but in my expectations, Bitcoin will break its all-time high by the end of the year. And by 2025, we might see exponential growth to $120,000,” Zvezdin forecasted.

Altcoins and Trends

Andrey Veliky also highlighted that, despite Bitcoin’s dominance, its price has not crossed the $70,000 mark in the last three months. Among altcoins, he singled out BNB and TRX, which are attracting attention due to the popularity of meme coins and the launch of platforms for trading them. Veliky also emphasized that TON is showing growth both in the total value of locked funds and user activity, making it a promising asset.

Conclusion

Amid the current market correction, uncertainty remains, influenced by macroeconomic factors and geopolitical instability. However, many analysts and experts believe that Bitcoin has the potential to reach new highs. At the same time, according to CoinMarketCap, there is a possibility of the bull market ending prematurely, which is causing disagreements among analysts.

CEO of Lekker Capital, Quinn Thompson, stated that the current correction is unsustainable and urged investors to buy Bitcoin during the dip, believing that the market will soon recover.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.