A wallet associated with the fraudulent ZKasino project has been liquidated on a 20x leveraged Ethereum (ETH) long position on Hyperliquid, resulting in a $27.1 million loss, according to Onchain Lens analysts.

A scammer gets a dose of karma.

— Onchain Lens (@OnchainLens) April 7, 2025

The ZkCasino scammer, who scammed $40M+, closed its $ETH (20x) position on #Hyperliquid, faced a total loss of $27.1M.https://t.co/2j6woL4KVM pic.twitter.com/cWEkWiQxDc

“Karma comes for the scammer,” noted the analytics platform.

ZKasino promoted itself as a decentralized gambling and blockchain casino platform, luring investors with promises of fund returns within 30 days, crypto journalist Colin Wu recalled.

“The ZKasino developers bet it all on ETH and got wrecked. Turns out, the house doesn’t always win,” commented one user.

Meanwhile, some traders took advantage of the April 7 market volatility. One whale opened a $4.52 million ETH long position with 20x leverage and closed it three hours later with a $1.87 million profit.

A whale who opened a long position with $4.52M in $ETH (20x) has closed the entire position, making a profit of $1.87M, in 3 hours.https://t.co/Y9aVQ3BcL2 pic.twitter.com/NavTtzaXZU

— Onchain Lens (@OnchainLens) April 7, 2025

Following a drop below $75,000, Bitcoin bounced back to trade near $76,700 (CoinGecko). Amid the rebound, another major trader deposited $5 million in USDC and opened a 20x leveraged long at $77,231.

A whale just deposited $5M $USDC and opened a $BTC long position with 20x leverage at $77,231.https://t.co/JWPzi3qIPP pic.twitter.com/gGmgexO2SW

— Onchain Lens (@OnchainLens) April 7, 2025

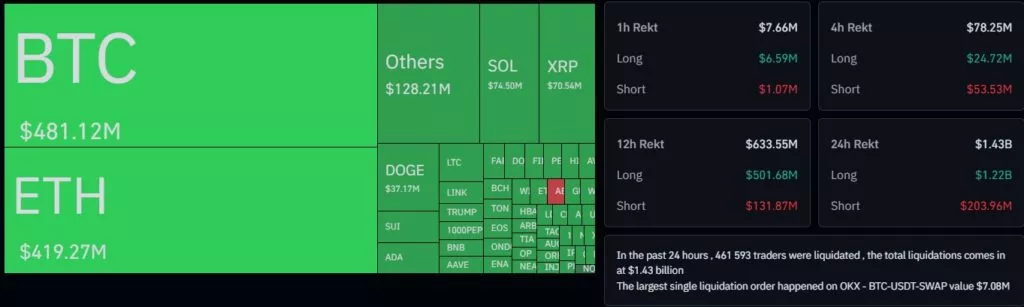

According to Coinglass, total liquidations on the options market over the past 24 hours reached $1.43 billion, with $1.22 billion coming from long positions. More than 461,600 traders were affected by forced closures.

The largest single liquidation was recorded on OKX — a $7.08 million order.

As a reminder, the recent market correction triggered a $106 million position (67,570 ETH) to be liquidated on the DeFi platform Sky after its collateral ratio dropped below the threshold.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.