China is actively working on establishing its own Strategic Bitcoin Reserve (SBR), according to Bitcoin Magazine CEO David Bailey.

China is now working double time to stand up their own Strategic Bitcoin Reserve.

— David Bailey🇵🇷 $0.85mm/btc is the floor (@DavidFBailey) March 2, 2025

They’ve been holding closed door meetings on the topic since the election.

He stated that closed-door meetings among Chinese officials on this matter began after the US presidential election in November 2024.

Bailey pointed out that he had previously reported in advance on the formation of the US SBR and the pardon of Silk Road founder Ross Ulbricht. Regarding his sources, he noted that Beijing has “quite a few hardcore Bitcoiners.”

A Potential Leader

On March 6, US President Donald Trump signed an order to establish an SBR, primarily based on state-confiscated BTC. This move was one of his campaign promises.

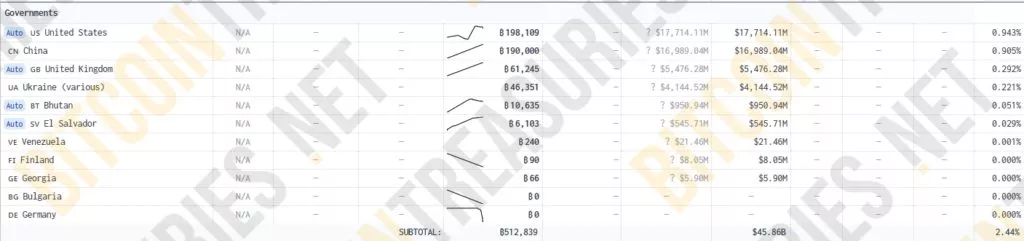

According to Bitcoin Treasuries, the US government controls 198,109 BTC. However, 120,000 BTC must be returned to Bitfinex, as these assets were seized from hacker Ilya Lichtenstein, who breached the exchange in 2016.

China holds 190,000 BTC, confiscated from PlusToken, one of the largest crypto Ponzi schemes. In 2020, media reports claimed that all PlusToken assets were sold for $4.2 billion, yet analysts have continued to track the movement of some confiscated crypto, including Ethereum.

In January 2025, CryptoQuant CEO Ki Young Ju suggested that China had liquidated all its crypto holdings via Chinese exchanges. Meanwhile, the Communist Party of China (CPC) stated that the assets had been “transferred to the national treasury,” but it did not specify whether they had been converted to fiat.

🇨🇳 China sold 194K #Bitcoin already, imo.

— Ki Young Ju (@ki_young_ju) January 23, 2025

PlusToken's seized BTC in 2019 was sent to Chinese exchanges like Huobi. The CCP said it was "transferred to the national treasury" without clarifying if it was sold.

A censored regime holding censorship-resistant money feels unlikely. pic.twitter.com/ODHD9rSR0d

“A censorship-driven regime holding censorship-resistant money—it seems unlikely,” noted the CryptoQuant CEO.

Who’s Next?

The UK holds 61,000 BTC, making it the third-largest government holder of Bitcoin. However, the British government has made no official statements about forming an SBR.

Ukraine reportedly holds 46,351 BTC, according to Bitcoin Treasuries, though the accuracy of this data remains uncertain.

Bhutan and El Salvador have confirmed holdings of 10,635 BTC and 6,103 BTC, respectively.

Since 2021, El Salvador has recognized Bitcoin as legal tender. However, the country has faced pressure from the IMF, which demands policy adjustments in exchange for a $1.4 billion credit agreement.

In 2024, Germany urgently sold 49,858 BTC, generating €2.6 billion ($2.88 billion). These assets were seized from the Movie2k piracy platform. The Bundestag criticized the liquidation, arguing that the BTC could have formed an SBR for Germany or even the EU.

Some Bitcoiners are saying the Strategic Bitcoin Reserve doesn’t do anything because it’s just seized assets and there’s no buying.

— Samson Mow (@Excellion) March 7, 2025

Well, there will be buying. There are a number of “budget neutral” ways to acquire Bitcoin such as issuing #BitcoinBonds or selling gold. Give it… pic.twitter.com/zBxYhQwMZ8

In Russia, the creation of a national Bitcoin reserve is “not being discussed” at the government level. However, Jan3 CEO Samson Mow believes that in the US-led SBR race, state-level Bitcoin acquisitions are inevitable, and Russia’s actions in this regard will be significant.

Mow also predicts that the US will continue increasing its Bitcoin reserve to maintain dominance in the sector.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.