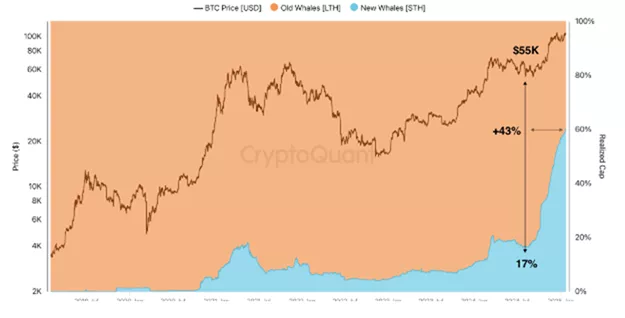

The share of investors holding 1,000+ BTC who acquired their coins within the past 155 days has climbed from 43% to 60%, according to CryptoQuant.

This metric is calculated relative to realized capitalization. Its increase points to the arrival of large new participants amid optimistic market sentiment.

Unlike “old” whales, who pursue longer-term strategies, “new” whales actively trade and respond more quickly to market conditions, CryptoQuant analysts noted. Their behavior typically reflects the current cycle phase.

The most recent surge in “new” whale share began when Bitcoin rose to $55,000.

According to CryptoQuant, the indicator tends to expand during periods of optimism and contract when uncertainty dominates.

Context

- CEO and co-founder of CryptoQuant, Ki Young Ju, has forecast a continued bull run for a couple of quarters, citing the global “advertising effect” of U.S. President Donald Trump.

- Earlier CryptoQuant findings revealed that large investors have supported Bitcoin since Trump’s election.

- Glassnode analysts observed a return to Bitcoin accumulation by hodlers after a sharp sell-off at the $100,000 level.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.