The total assets under management (AUM) of all U.S. Bitcoin ETFs have exceeded $129 billion, surpassing the AUM of gold exchange-traded funds, according to K33 Research Head of Research Vetle Lunde.

In the United States, Bitcoin ETF AUM has surpassed gold ETF AUM.

— Vetle Lunde (@VetleLunde) December 17, 2024

Gold, with a 20-year head start, has been flipped. pic.twitter.com/nyCWtKtQaB

“Gold, with its 20-year head start, has lost its leadership,” noted the researcher.

This figure represents the combined AUM of all types of Bitcoin ETFs in the U.S. According to Bloomberg analyst Eric Balchunas, the total AUM of spot, futures, and leveraged Bitcoin funds is around $130 billion, surpassing the $128 billion for gold ETFs.

People asking me about this. Answer is YES, if you include all bitcoin ETFs (spot, futures, levered) they have $130b vs $128b for gold ETFs. That said, if you just look at spot, btc is $120b vs $125b for gold. Either way, unreal we even discussing them being this close at 11mo. https://t.co/hq8QAc14Xa

— Eric Balchunas (@EricBalchunas) December 17, 2024

“Looking solely at spot instruments, Bitcoin’s AUM is $120 billion compared to $125 billion for gold. Still, it’s incredible that we’re even discussing such a small gap just 11 months after launch,” Balchunas added.

The AUM for U.S. spot Bitcoin ETFs alone stands at $115.75 billion, with a peak value of $121.68 billion.

The growth in inflows to U.S. crypto funds has intensified amid the U.S. presidential elections, with uninterrupted inflows since November 27.

As of December 12, total inflows since the launch exceeded 500,000 BTC, representing over 2.5% of all circulating coins.

According to Galaxy Research, the ratio of Bitcoin’s market capitalization to gold’s reached a historic high of 14%.

🚨 #Bitcoin market cap as % of Gold market cap reaches new all-time high at 14% pic.twitter.com/FP42fnkjle

— Alex Thorn (@intangiblecoins) December 16, 2024

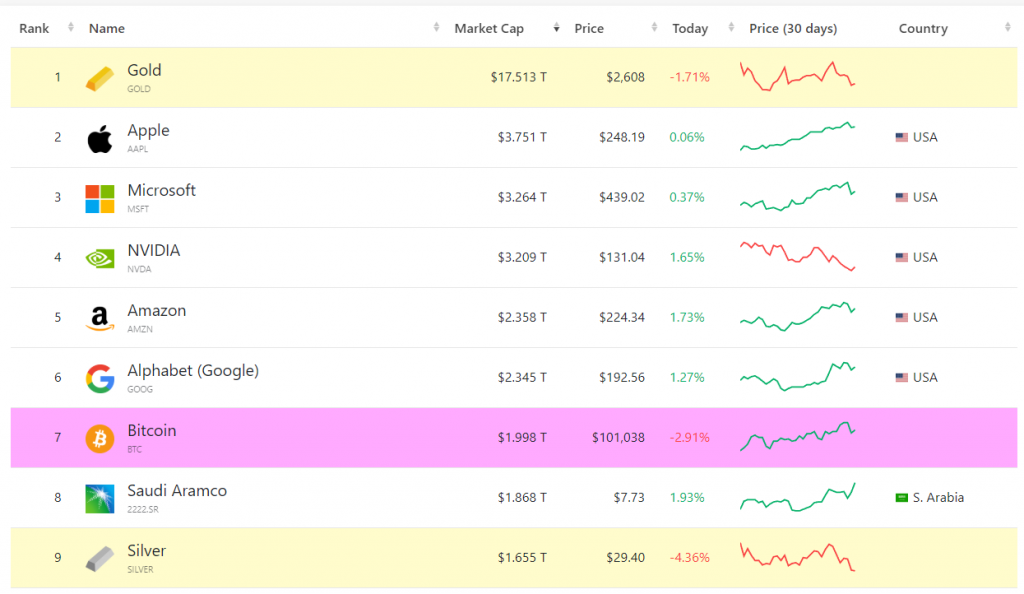

Bitcoin is now ranked seventh in market capitalization among public companies, cryptocurrencies, and ETFs — higher than silver but below gold and the world’s five most valuable corporations.

At the time of writing, Bitcoin is trading at $100,500, with a market capitalization of $1.99 trillion.

According to CoinGecko, the total market capitalization of the crypto market stands at $3.66 trillion.

Notably, on November 18, Bitcoin’s price dropped below $104,000 following a Federal Reserve rate cut.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.