In 2025, investment advisors are expected to increase their allocations in Bitcoin and Ethereum-based ETFs to over 50%, according to CF Benchmarks, as reported by CoinDesk.

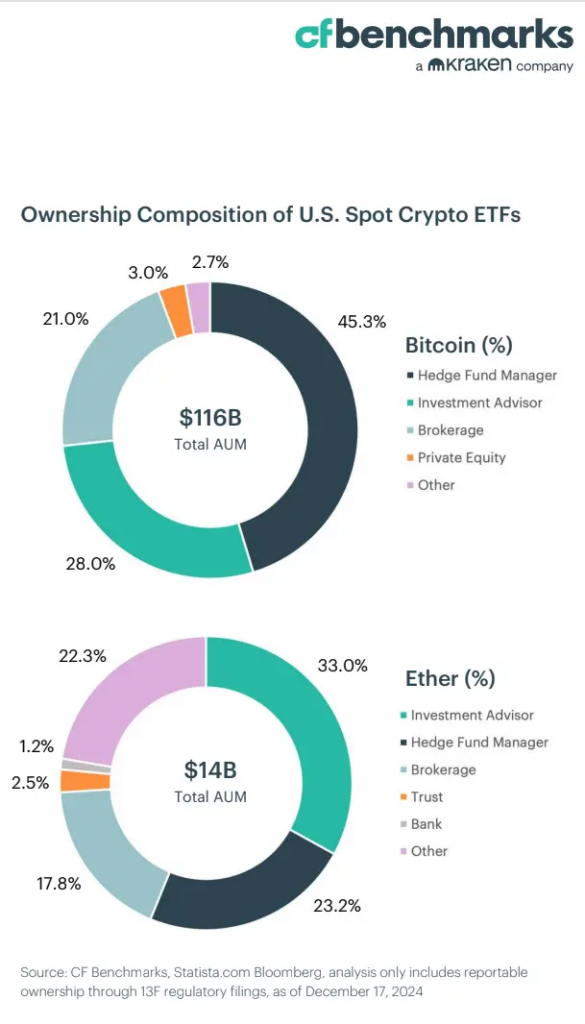

Since their inception, U.S. spot cryptocurrency ETFs have attracted $36 billion in capital from various entities. Hedge fund managers currently dominate the space, holding approximately 45.3% of crypto products, while investment advisors—acting as intermediaries for retail and high-net-worth clients—hold the second-largest share at 28%.

CF Benchmarks forecasts a significant shift in the coming year:

“We expect investment advisor allocations to surpass 50% for BTC and ETH as the $88 trillion U.S. asset management industry begins to embrace these tools. Net inflows into these products will exceed the $40 billion recorded in 2024.”

This transformation, driven by increasing client demand, greater understanding of digital assets, and the evolution of ETF products, is likely to reshape the current structure of the crypto ETF market. Investment advisors are already leading in Ethereum-focused funds and are expected to further strengthen their position next year.

CF Benchmarks also predicts that Ethereum will benefit from the rising trend of asset tokenization, while competitor Solana is poised to expand its market share amid potential regulatory clarity in the U.S.

Experts anticipate the Federal Reserve (Fed) will adopt a more measured approach, employing unconventional measures such as yield curve control or expanded asset purchases. These steps are seen as solutions to the toxic mix of high debt servicing costs and a weak labor market.

“Deeper debt monetization should raise inflation expectations, reinforcing hard assets like Bitcoin as a hedge against currency devaluation,” the analysts emphasized.

Market Context

During the week of December 15-21, cryptocurrency investment funds saw inflows of $308 million, down sharply from $3.2 billion the previous week. This decline coincided with the Fed’s “hawkish” rate cut, which tempered market sentiment.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.