The last time such large-scale derivative liquidations and a sharp reversal of the growing open interest trend were recorded was in August 2023, according to CryptoQuant analysts.

Experts noted that the situation clearly demonstrated how large the group of investors was that felt overly confident and optimistic.

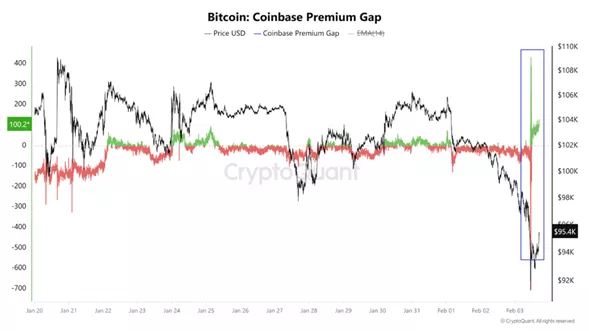

Amid falling prices and worsening sentiment, analysts observed signs of aggressive buying, reflected in the Coinbase premium dynamics.

As a result, the market has already undergone a “significant cleansing.”

“While a period of high volatility cannot be ruled out, whales will eventually move in the opposite direction,” the report states.

CryptoQuant’s conclusions on the “weakening of speculation” are supported by Glassnode metrics.

#Bitcoin’s perpetual market shows cooling speculation:

— glassnode (@glassnode) February 3, 2025

🔻The drop to $93K sent the long-side premium to -$158K/hour.

🔻The 7-day average fell $181K, signaling persistent pressure.

This mirrors post-ATH weakness in April 2024, when funding also turned negative, reflecting a… pic.twitter.com/uKWQLJLCT5

According to experts’ calculations, the perpetual contracts market is experiencing a “remake” of April 2024. Back then, after reaching an all-time high and a subsequent pullback, funding rates turned negative, reflecting growing bearish sentiment.

Separately, CryptoQuant revisited the thesis of an approaching late-stage bull run.

Experts pointed out that the market is currently transitioning from the accumulation phase (marked in orange) to the distribution phase (marked in cyan).

“Bitcoin still has the potential to reach significantly higher levels. The funding rate [of perpetual contracts] remains relatively low and is comparable to the levels of summer 2024. We are far from a market with excessive leverage. The structure supports the further development of the bull run,” the report states.

According to CryptoQuant’s calculations, the “fair” value of Bitcoin can be estimated at $87,990.

Recall that over the next two months, digital gold is expected to rise to $112,000–$130,000 due to increased institutional inflows and a shift in sentiment toward risk acceptance, according to Standard Chartered.

Earlier, Bitwise predicted “less severe” Bitcoin corrections thanks to initiatives by U.S. President Donald Trump.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.