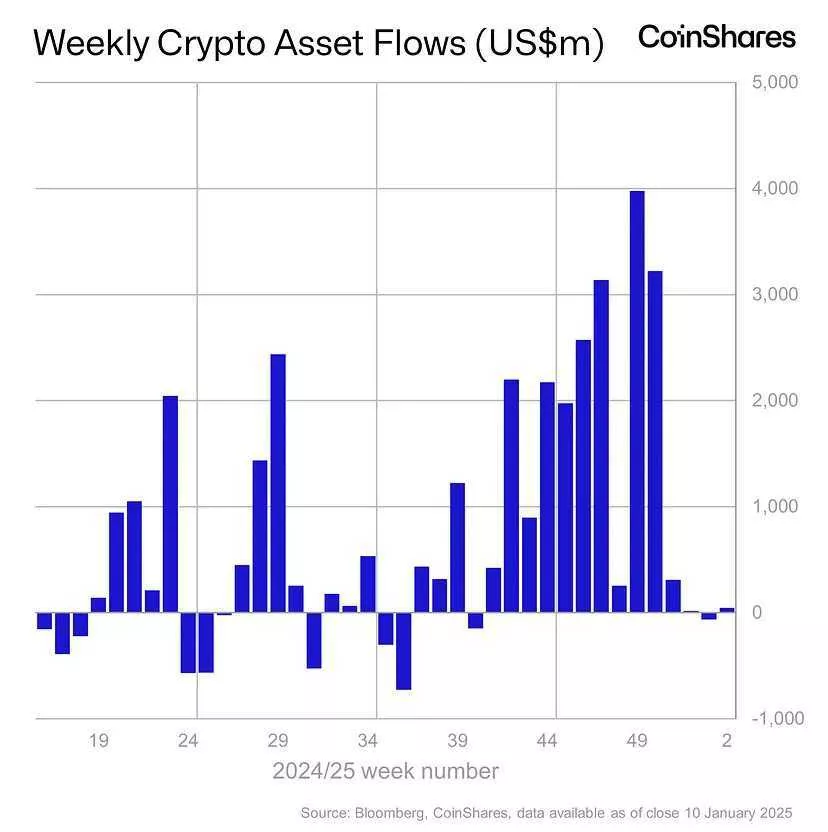

From January 4 to January 10, crypto investment products saw inflows totaling $44.2 million, according to CoinShares. Analysts noted a weak start to the new year driven by macroeconomic data from the U.S.

According to the firm, inflows of approximately $1 billion were observed prior to the “hawkish” minutes released from the most recent Federal Reserve meeting on January 8.

The situation worsened following the U.S. jobs report for December (published on January 10), which led to a reassessment of expectations regarding future rate hikes. As a result, investors withdrew $940 million over the remaining days of the week.

“The honeymoon after celebrating the outcome of the U.S. elections has ended. Macroeconomic data once again serves as a key driver,” the experts remarked.

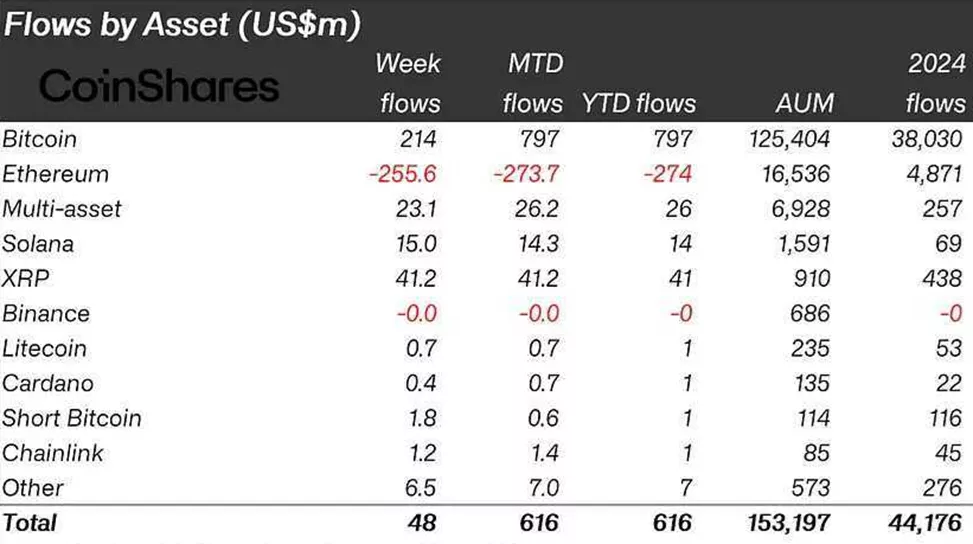

Bitcoin-based products attracted $214 million over the week, bringing the year-to-date total to $797 million.

Short-Bitcoin funds received $1.8 million in inflows.

Ethereum-based funds experienced significant outflows of $255.6 million. CoinShares attributed this negative dynamic to the asset’s high sensitivity to sell-offs in the U.S. tech sector.

In contrast, Solana-backed products showed no such correlation, adding $15 million in inflows.

Funds linked to XRP took in a substantial $41.2 million, which experts tied to market optimism ahead of the SEC’s looming deadline to appeal the court’s decision on the token’s status.

Despite the challenging environment, instruments based on Aave, Stellar, and Polkadot still pulled in $2.9 million, $2.7 million, and $1.6 million, respectively.

Context

- QCP Capital previously noted that this week may stoke renewed interest in crypto as a hedge against inflation.

- In 2024, crypto fund inflows hit a record $44 billion.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.