Bitcoin prices could drop to the support level of $72,000, according to Ilya Kalchev, an analyst at Nexo, in a conversation with Cointelegraph.

He stated that the market is currently “regrouping,” and a quick recovery for digital gold remains uncertain due to a sharp decline in investor sentiment.

“A temporary pullback is possible as the market fills gaps left by the rapid rally. More likely, Bitcoin will establish strong support in the $72,000-$80,000 range,” Kalchev noted. This level, he believes, “could provide a foundation for a more sustainable recovery, reducing the risk of a deep correction.”

Technical analyst Omkar Godbole argues that Bitcoin’s sell-off might be a “healthy retest” of $73,835. The downward momentum could weaken near this level, setting the stage for a stronger rebound.

Market Fear Intensifies

With increased bearish pressure, the Fear & Greed Index plunged to 10 on February 27, signaling extreme panic. The last time such low levels were recorded was in June 2022, when Bitcoin crashed to $17,500 (-37% in a month).

As of now, the index has recovered slightly to 20, still reflecting widespread market fear.

According to analysts at Bitfinex, deteriorating investor sentiment is driven by several internal and external factors:

“Bitcoin’s sharp price drop, regulatory uncertainty, platform hacks, and altcoin devaluation have collectively led to an extreme level of market fear.”

On the positive side, experts highlighted the rapid liquidity recovery on Bybit.

At the time of writing, Bitcoin is trading at $84,650, up 3.3% in the last 24 hours, according to CoinGecko.

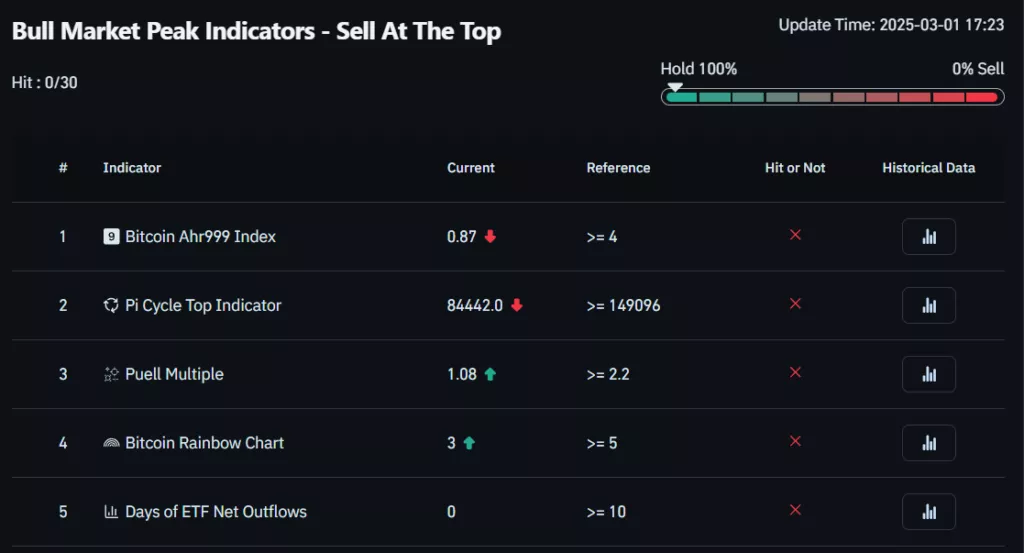

Meanwhile, all key indicators tracked by Coinglass suggest it is still reasonable to hold Bitcoin in portfolios during this cycle.

Reminder: Matrixport analysts predict that the correction could last until March or April. They also noted that with Traditional Finance (TradFi) investors increasingly trading Bitcoin ETFs, macroeconomic factors are becoming more influential in Bitcoin’s price movements.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.