Mining company MARA Holdings has purchased an additional 15,574 BTC for a total of $1.53 billion at an average price of ~$98,529 per coin.

MARA raised $1.925 billion from 0% convertible notes in November and December. Using the proceeds from its zero-coupon convertible notes offerings, MARA has acquired 15,574 BTC for ~$1.53 billion at ~$98,529 per #bitcoin and repurchased ~$263 million in aggregate principal amount… pic.twitter.com/ycGRk9BYfv

— MARA (@MARAHoldings) December 19, 2024

The company utilized $1.925 billion raised through convertible bond offerings in November and December for the acquisitions.

Approximately $263 million of the proceeds were used to repurchase existing bonds maturing in 2026. MARA plans to use the remaining funds to further increase its Bitcoin reserves.

“As of December 18, 2024, we hold 44,394 BTC, currently valued at $4.45 billion based on a spot price of $100,151,” the company stated.

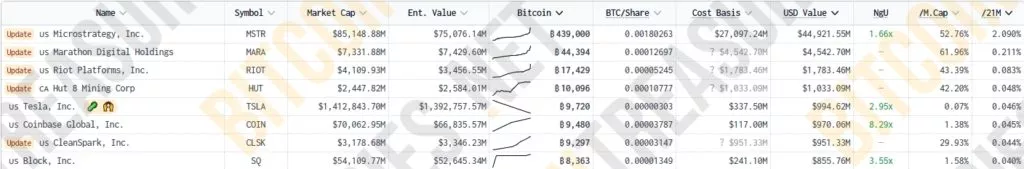

JPMorgan analysts noted in early December that public miners are increasingly adopting MicroStrategy’s strategy of accumulating Bitcoin on their balance sheets to boost shareholder value. MARA has led this trend, followed by Riot Platforms and Hut 8 Corp.

Hut 8 announced on December 19 that it had acquired 990 BTC for approximately $100 million, at an average purchase price of $101,710 per coin.

Hut 8 today announced the purchase of approximately 990 Bitcoin for approximately $100 million, or an average of approximately $101,710 per Bitcoin. Combined with the Bitcoin held prior to this purchase, Hut 8’s strategic Bitcoin reserve now totals more than 10,000 Bitcoin with a… pic.twitter.com/BhgCNMMEJu

— Hut 8 (@Hut8Corp) December 19, 2024

The company’s Bitcoin holdings have now grown to 10,096 BTC, valued at roughly $1 billion.

“Bitcoin reserves are a key component of our treasury policy, supporting a flywheel effect that aligns our capital and operational strategies to accelerate value creation across the business,” said Hut 8 CEO Asher Genoot.

According to Bitcoin Treasuries, MARA confidently holds second place among corporations in terms of digital reserves, second only to MicroStrategy, which has accumulated 439,000 BTC.

Hut 8’s purchase of 990 BTC has propelled it to a solid fourth place in the rankings, surpassing competitors such as CleanSpark, Coinbase, and Elon Musk’s Tesla.

Notably, U.S. President-elect Donald Trump has confirmed his intention to establish a national Bitcoin reserve.

Former BitMEX CEO Arthur Hayes expressed skepticism about the initiative, predicting that the new administration’s policies in January would disappoint investors, leading to a “painful crash” in cryptocurrency markets.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.