Bitcoin mining company Mara Holdings negotiates the acquisition of 64% in the French data center provider Exaion for $168 million, reports Bloomberg.

The deal reflects the strategic reversal of MARA: instead of the traditional focus on the infrastructure for large data centers, the company relies on the segment AI-inference — Data processing technologies for artificial intelligence.

The current owner of Exaion is the investment division of the energy concern EDF – Save your share. The agreement also provides an option to increase the MARA package to 75% for an additional payment $127 million.

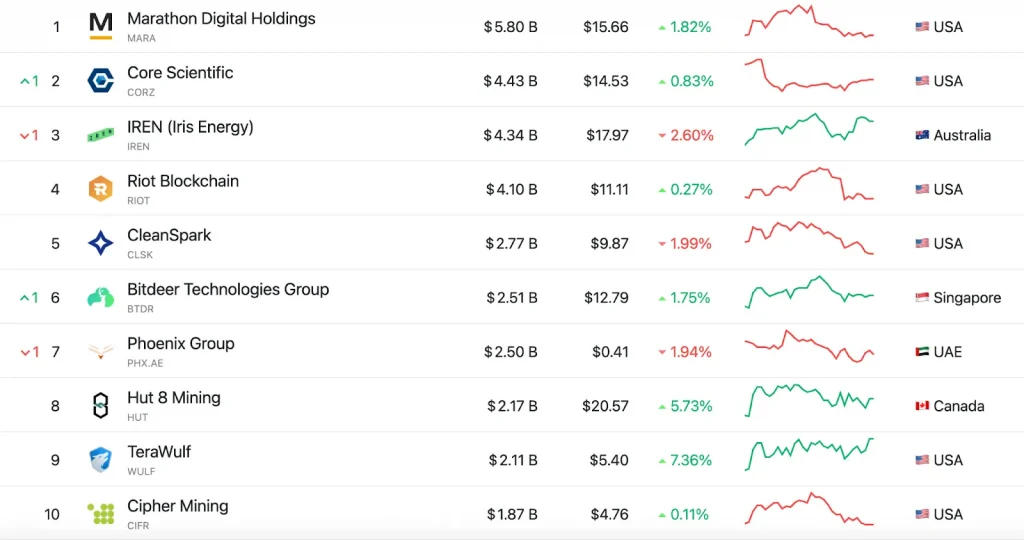

with capitalization $5.8 billion Mara remains the largest miner in the industry.

competitors’ activity

In the context of diversification of the mining sector, the company CANGO (NYSE: CANG) continues to expand in the field of production. She purchased a farm 50 MW in Georgia for $19.5 million. The object is ready for operation and is equipped with energy distribution systems, racks for immersion cooling and a staff of specialists.

Cango plans to send 30 MW for own mining, and the rest 20 MW – for hosting third-party clients.

After rebranding in 2025, the company changed its specialization from automotive services to cryptocurrency infrastructure. She recently entered the 50 EH/S Club alongside Mara and CleanSpark.

As of August 8, CANGO reserves are 4678.9 BTC (~$561 million), and in a week the company got 149.1 BTC.

#WeeklyUpdate Cango mined 149.1 #BTC this week, pushing our total bitcoin holdings to 4678.9 BTC.

— CANGO (@Cango_Group) August 8, 2025

Staying in full #HODL mode as we close in on 5,000 BTC.#CryptoMining #Bitcoin $CANG pic.twitter.com/4epJQmQ9MJ

Recall that on August 9, the complexity of the Bitcoin network increased by 1.42% – to 129.44 twhich became a new historical maximum.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.