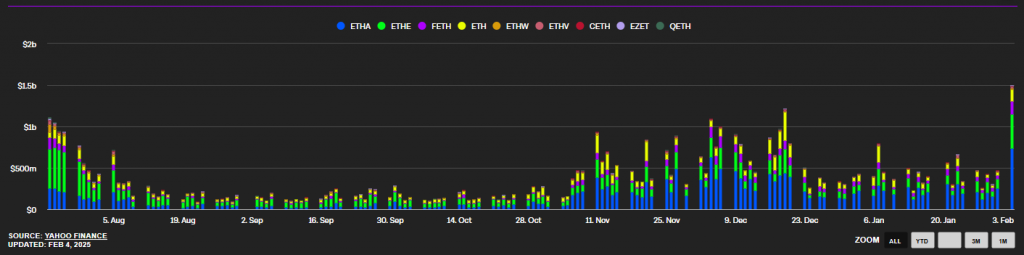

Amid the recent market downturn, the daily trading volume of U.S. spot Ethereum ETFs reached an all-time high of $1.5 billion on February 3.

The previous record was $1.22 billion, set on December 19.

The top fund by trading volume was ETHA from BlackRock, with $736 million. ETHE from Grayscale ranked second with $415 million, followed by FETH from Fidelity at $155 million.

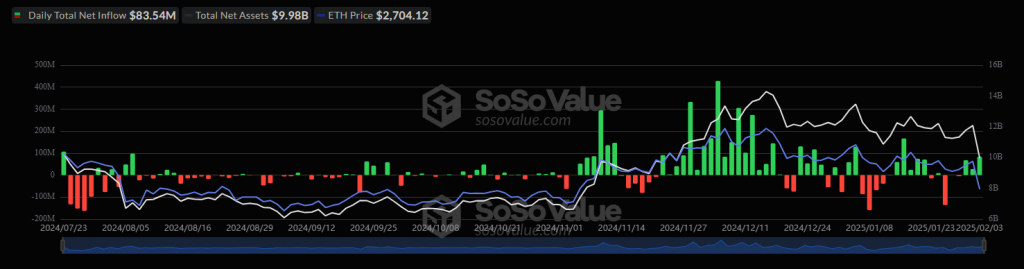

Net inflows into U.S. ETH ETFs on February 3 totaled $83.54 million, the highest level since January 16. The largest inflow was recorded in FETH ($49.75 million), followed by ETHE ($15.85 million), ETH ($12.75 million), and CETH ($5.19 million).

At the same time, U.S. Bitcoin ETFs saw an outflow of $234.54 million, with $177 million coming from FBTC by Fidelity.

According to a CME report, the average daily trading volume of cryptocurrency futures in January reached 198,000 contracts—an increase of 180% compared to the same period in 2024. The surge was primarily driven by micro contracts on BTC and ETH, which saw trading volumes grow by 255% and 223%, respectively.

Notably, in February, Bitwise CIO Matt Hougan predicted that spot Bitcoin ETFs could attract $50 billion in inflows by 2025.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.