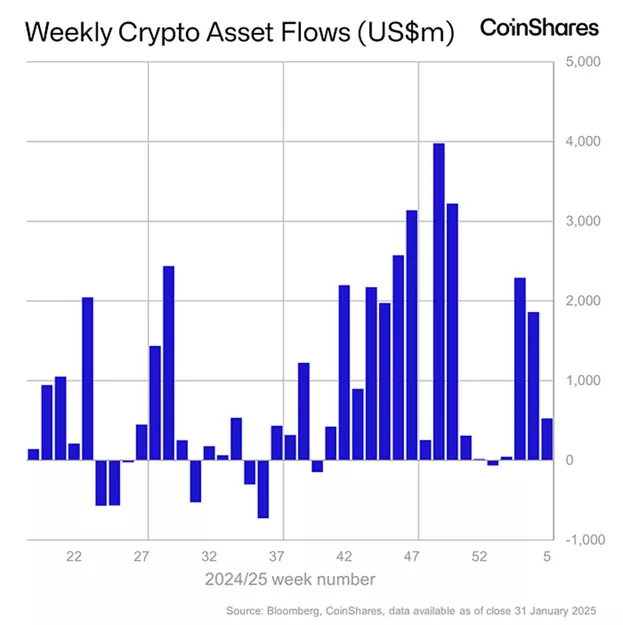

From January 25 to 31, cryptocurrency investment funds attracted $527 million, down from $1.9 billion the previous week, according to CoinShares.

Analysts noted that mid-week flows reflected unstable investor sentiment, largely influenced by news surrounding DeepSeek and speculation about potential U.S. tariff hikes. However, by the end of the period, inflows turned positive.

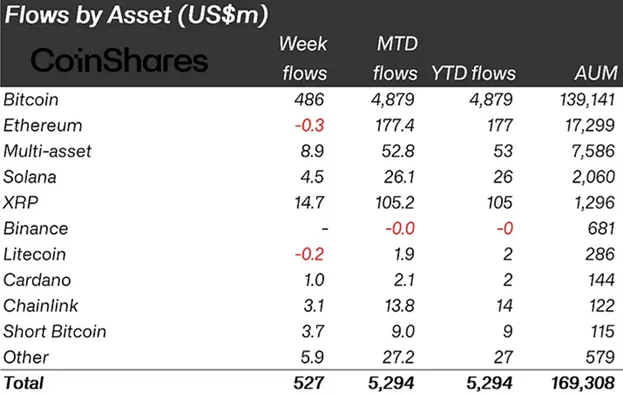

Bitcoin-based funds saw $486 million in inflows for the week, bringing the year-to-date total to $4.88 billion.

Short BTC investment products attracted $3.7 million in inflows, down from $5.1 million the previous week.

Ethereum funds saw $0.3 million in outflows, following a $204.7 million inflow the week before.

XRP-based products experienced a slowdown in inflows, from $18.5 million to $14.7 million.

Funds focused on Solana, Chainlink, and Cardano attracted $4.5 million, $3.1 million, and $1 million, respectively.

Previously, Bitwise estimated that spot Bitcoin ETFs could see $50 billion in inflows in 2025.

As a reminder, according to Bernstein, TradFi investors are only beginning to explore digital assets.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.