The U.S. Securities and Exchange Commission (SEC) has extended by 45 days its deadline to rule on the proposed conversion of Bitwise’s crypto index fund into an exchange-traded fund (ETF).

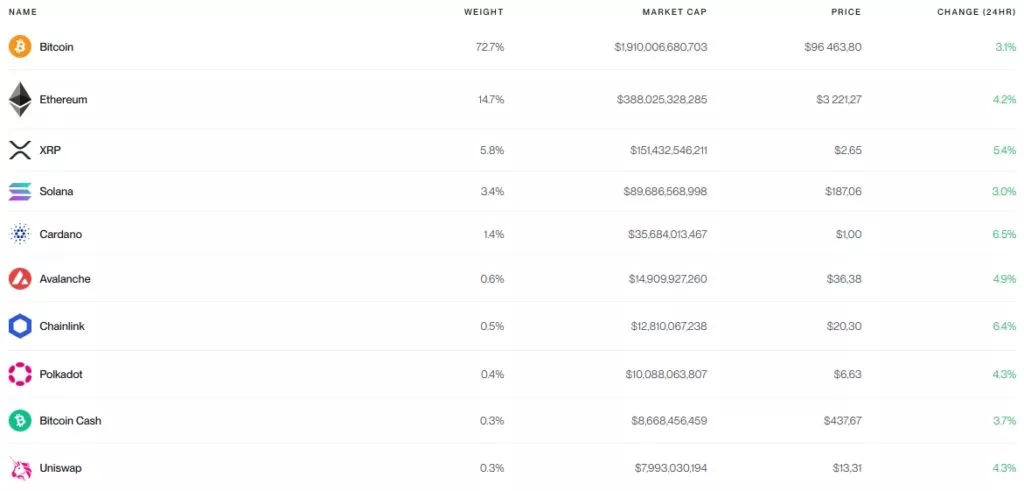

According to the company’s website, the Bitwise 10 Crypto Index Fund (BITW) tracks the “10 most valuable and established cryptocurrencies” by market cap, with monthly rebalancing of the basket.

In November, NYSE Arca filed on behalf of Bitwise a proposal asking the SEC to change listing rules for the product. The regulator’s initial decision was due by January 17. However, the Commission has postponed its verdict until March 3, citing the need for additional time to review the proposal.

Bloomberg ETF analyst James Seyffart called the delay “expected.”

Update: As expected the SEC has punted/delayed the decision on @BitwiseInvest's filing to convert the Bitwise 10 Crypto Index Fund (BITW) into an ETF. Final deadline is in late July pic.twitter.com/wRzaROBNqy

— James Seyffart (@JSeyff) January 14, 2025

“The final deadline is the end of July,” the expert reminded.

He also predicts the SEC will similarly delay its February 2 decision regarding the request by Grayscale to convert its mixed crypto fund into an ETF.

Bitwise already issues spot-based Bitcoin and Ethereum ETFs. As of January 13, following net outflows, assets under management (AUM) in its BTC-ETF fell to $3.75 billion. By comparison, the 10 Crypto Index Fund manages $1.4 billion.

In November, Bitwise applied to launch a combined ETF based on the two largest cryptocurrencies by market cap. A month earlier, the company had requested approval for a spot-based XRP fund.

Context

- JPMorgan analysts speculated that, if approved, such exchange-traded products centered on Ripple’s token could attract up to $8 billion in six months.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.