Former head of the bankrupt crypto exchange FTX, Sam Bankman-Fried (SBF), stated that he ‘the biggest mistake’ In the midst of the collapse of the company, the decision was made transfer management to a new manager, which he said deprived him of his last chance to save the stock exchange.

Bankman-Fried, who previously headed a market value exchange in $32 billion, is currently departing 25-year prison term seven criminal articles related to the collapse FTX and its subsidiary Alameda Research. As a result of the collapse, investors lost about $8.9 billion.

‘The biggest mistake is the transfer of the company’

According to the SBF, a fatal decision was made November 11, 2022when he passed the leadership John J. Ray III, the current CEO FTX.

“The biggest, and perhaps the only fatal solution, is the transfer of the company into the wrong hands,” Bankman-Fried said in an interview Mother Jonespublished on Friday.

He claims that literally after a few minutes After signing the documents, he received a call about a possible external investmentwhich could save the exchange from bankruptcy. However, the moment has already been missed.

After Ray took office FTX immediately filed for Chapter 11 bankruptcyby hiring a law firm Sullivan & Cromwell (S&C) to accompany the case.

in less than a month December 12, 2022, Bankman-Fried was arrested in the Bahamas, and in January 2023 he was extradited to the United States.

How FTX lost billions

FTX collapsed because of misuse of client funds. these assets were transferred to accounts Alameda Researchto cover the company’s trade losses – what later got its name ‘Alameda Break’ (Alameda Gap).

Two days before the crash November 9, 2022, lawyer S&C Andrew Ditderich sent a letter to Bankman-Fried asking him to hire Ray as a ‘restructuring director’ in the event of a possible bankruptcy.

later, in February 2024, FTX lenders sued S&Cby accusing the firm of promoting fraud and breach of trust. However, in the fall of 2024, the claim was voluntarily recalled.

According to Reuters, to June 27, 2024 S&C earned on escorting the bankruptcy case of FTX more than $171.8 million in the form of legal fees.

Lenders are still waiting for $4.2 billion

Almost three years after the FTX crash, users continue to expect full refund.

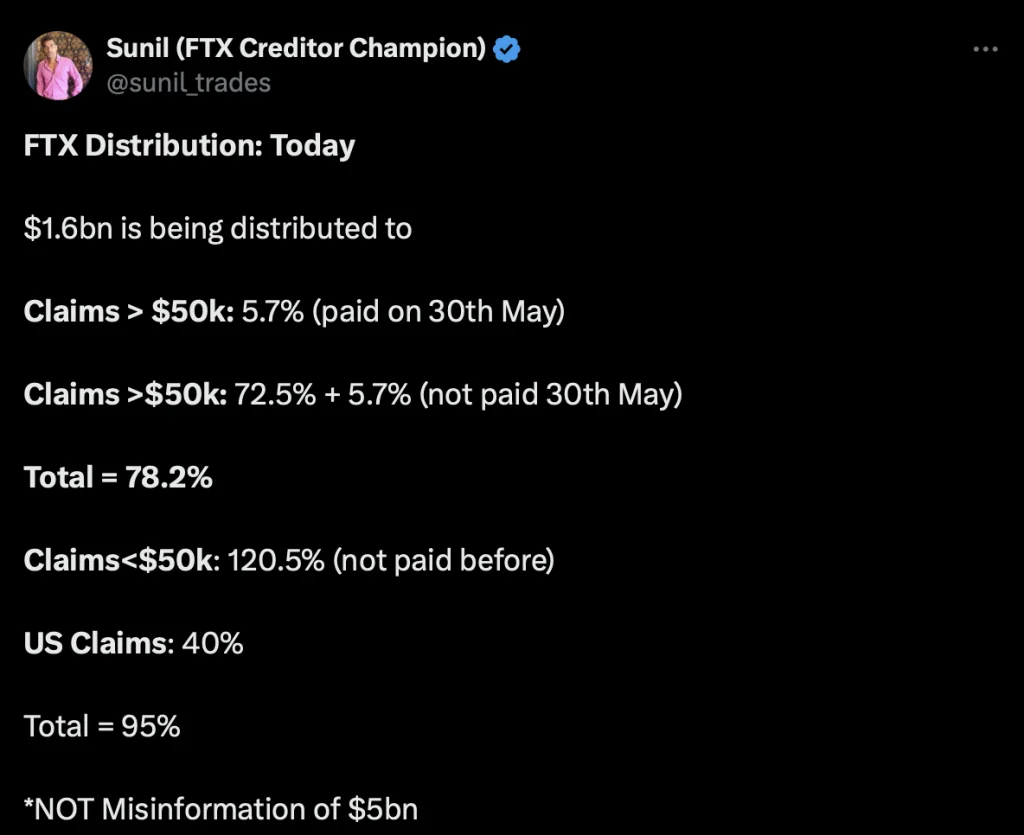

The compensation process began in February with payments to $1.2 billion, then followed the tranche on $5 billion in May. In September, creditors received more $1.6 billionby bringing the total amount of returns to $7.8 billion.

Taken: Sunil (FTX Creditor Champion) X

It is estimated that FTX has left up to $16.5 billion assets, which will allow customers to pay more about $8.7 billion.

The company plans to compensate 98% of users at the level 118% of the amount on their accounts As of November 2022.

FTX collapse has become The starting point of the chain reaction bankruptcy in the crypto industry and led to one of the most protracted bear markets.

against the backdrop of a crisis Bitcoin collapsed to $16,000which marked the beginning of a period of total distrust of centralized exchanges.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.