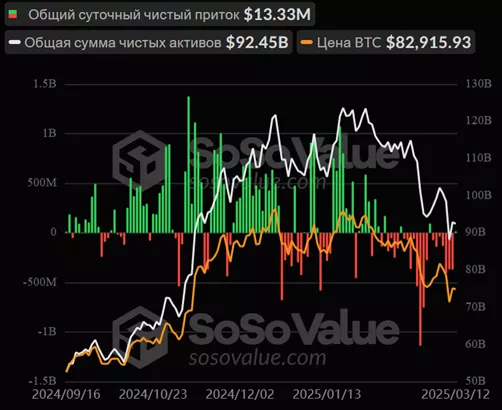

On March 12, inflows into spot Bitcoin ETFs reached $13.33 million, breaking a seven-day outflow streak that saw investors pull $1.54 billion from the products.

The total net inflow has now risen to $35.4 billion, with AUM standing at $92.45 billion. Since their January 2024 launch, Bitcoin ETFs have recorded only 21 days of net outflows.

On March 12, the ARKB ETF by ARK Invest & 21Shares led the recovery with $82.6 million in inflows.

Ethereum ETFs

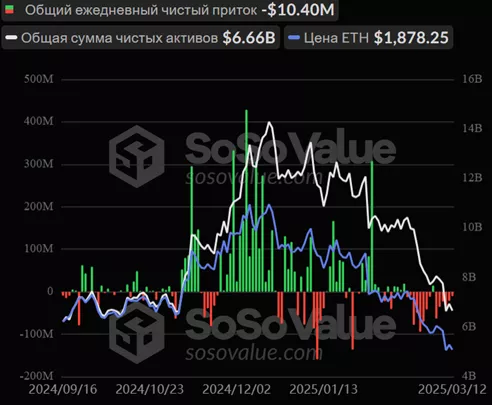

Meanwhile, the negative streak for Ethereum spot ETFs has now extended to six days. On March 12, investors withdrew $10.4 million, bringing the total outflows during this period to $181.4 million.

Total inflows into Ethereum ETFs have fallen to $2.63 billion, with AUM dropping to $6.76 billion.

New SEC Filing

On March 12, CBOE, on behalf of Invesco Galaxy, submitted a proposal to the SEC seeking approval for physical creation and redemption mechanisms for its Bitcoin and Ethereum ETFs. The SEC has now taken the application under review.

A similar request was filed in January 2025 on behalf of ARK Invest and 21Shares for their Bitcoin and Ethereum ETFs.

Notably, on March 11, the SEC extended its review of multiple spot ETF applications for XRP, Solana, Litecoin, and Dogecoin.

Earlier, Standard Chartered predicted continued BTC-ETF outflows, while Bitwise projected that up to $50 billion could flow into such structures in 2025.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.