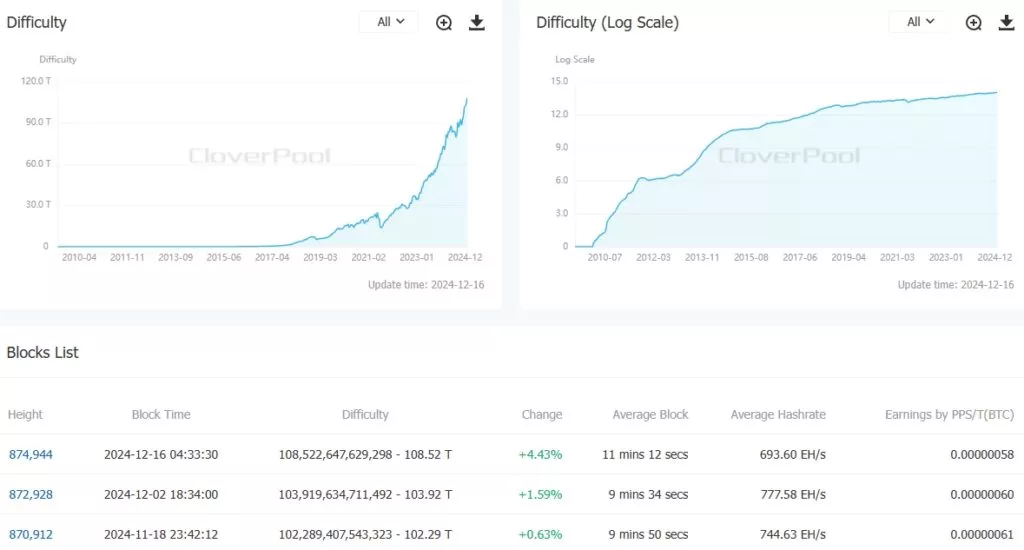

Following the latest adjustment, Bitcoin mining difficulty increased by 4.43%, reaching an all-time high of 108.52 T.

The average hash rate over the past two weeks stood at 772.2 EH/s, while the block interval exceeded 11 minutes. This suggests a potential decrease in difficulty during the next recalculation.

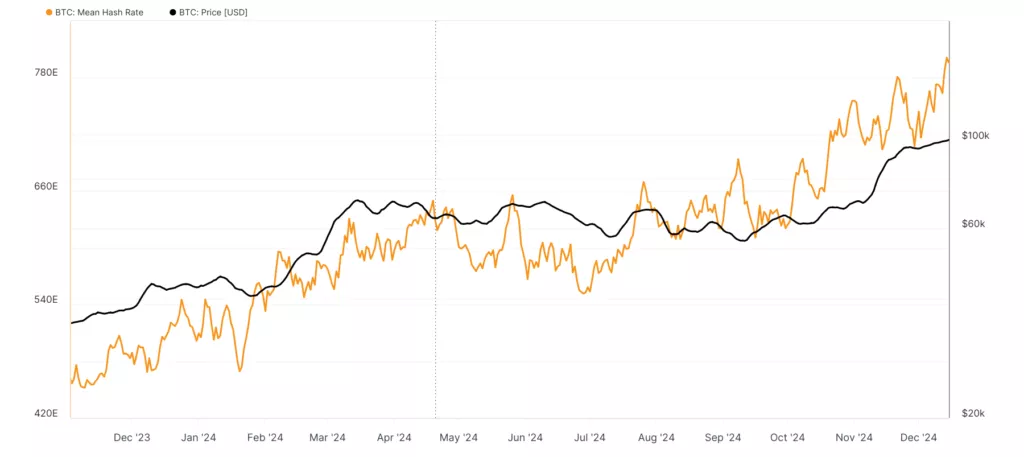

According to Glassnode, the 7-day moving average of the network’s computational power peaked at 801.1 EH/s on December 14. At the time of writing, it has slightly decreased to 796 EH/s.

Data from Hashrate Index shows that hash price briefly recovered to $64.5 per PH per day as Bitcoin surpassed its ATH of $106,000. However, the rise in mining difficulty and slight price correction have pushed the metric down to $62.3.

In November, miners collectively earned $1.21 billion, with fees accounting for only $38.7 million (3.2% of the total revenue), according to The Block. By comparison, March—just before the halving—saw revenues of $2.1 billion, including $85.8 million from transaction fees.

JPMorgan Insights on Mining Profitability

In November, JPMorgan analysts reported a 29% increase in Bitcoin mining profitability. This rise reflects the ongoing robustness of the mining industry amid growing network activity and higher prices.

Note: Difficulty recalculations ensure network stability by adjusting every 2,016 blocks (~two weeks) to match the target block interval of 10 minutes.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.