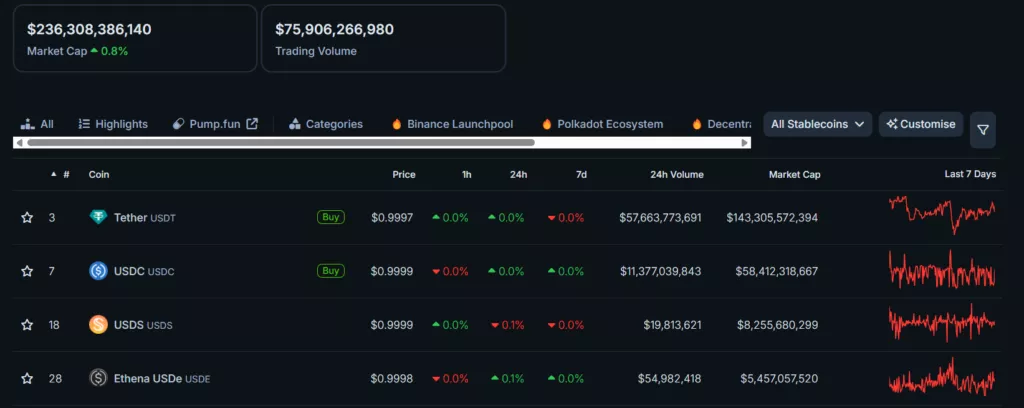

The market capitalization of the stablecoin sector has reached $236 billion, surpassing Ethereum’s $230 billion at the time of writing.

USDT by Tether remains the undisputed leader among stablecoins, with $143.3 billion in circulation, accounting for 60.6% of the total market. USDC follows with $58.4 billion, representing 24.7% of the sector.

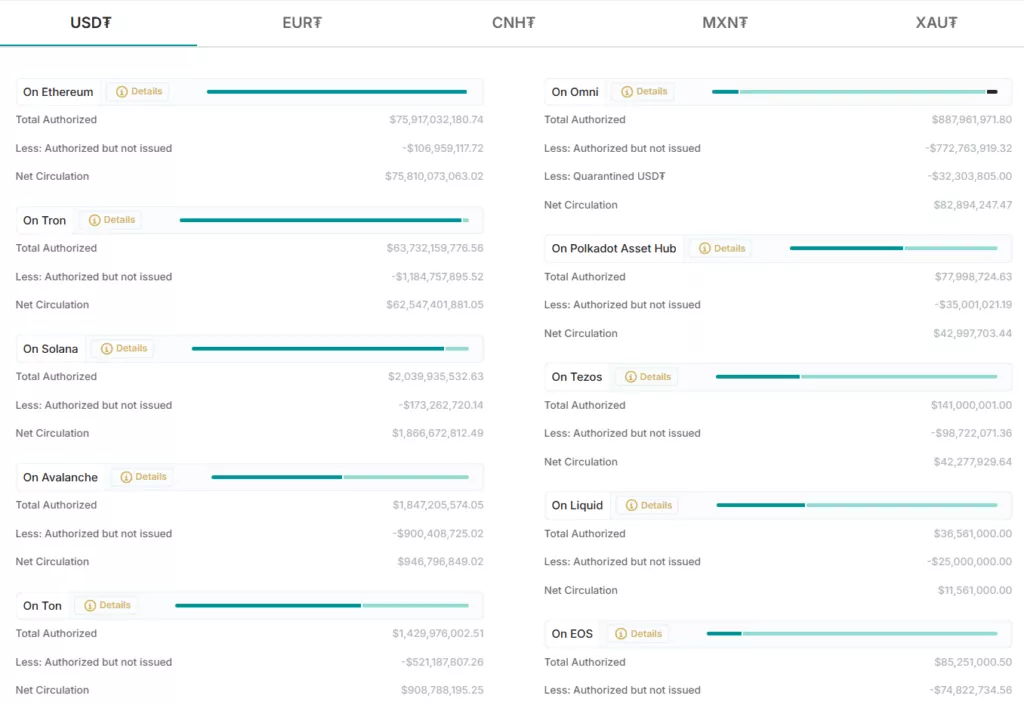

The majority of USDT supply is issued on Ethereum ($75.9 billion), followed by Tron ($63.7 billion) and Solana ($2 billion).

Despite trailing USDT, USDC is experiencing significant growth. According to CryptoRank, USDC’s total supply has surged by 32%.

Solana’s share in the stablecoin market is also rising.

“Since the start of the year, stablecoin supply on Solana has increased from $5 billion to $11.8 billion, with USDC making up $9.2 billion. This mirrors the situation on the Base network, where USDC dominates, comprising 92% of total stablecoin volume,” analysts noted.

Buy the Dip Incoming?

Santiment analysts recorded a spike in on-chain activity, with USDT transfers reaching a six-month high on March 11.

💸 Tether's on-chain activity has been rapidly rising, with over 143K wallets making transfers yesterday alone (a 6-month high). When $USDT & other stablecoin activity spikes during price drops, traders are preparing to buy. Added buy pressure aids in crypto prices recovering. pic.twitter.com/siFOR7vSf7

— Santiment (@santimentfeed) March 12, 2025

“When activity in USDT and other stablecoins rises during a market dip, it signals that traders are preparing to buy. Increased buying pressure helps prices recover,” experts explained.

A similar opinion was shared with Cointelegraph by Kronos Research CIO Vincent Liu, who pointed out that traders often accumulate Tether stablecoins during market downturns to prepare for new entry points.

Nansen analysts also detected whale transactions, with over $700 million in USDC transferred to Coinbase, suggesting that large players are preparing for aggressive buying, potentially leading to a market recovery.

Reminder: Binance will delist USDT and other non-compliant stablecoins under MiCA regulations on March 31.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.