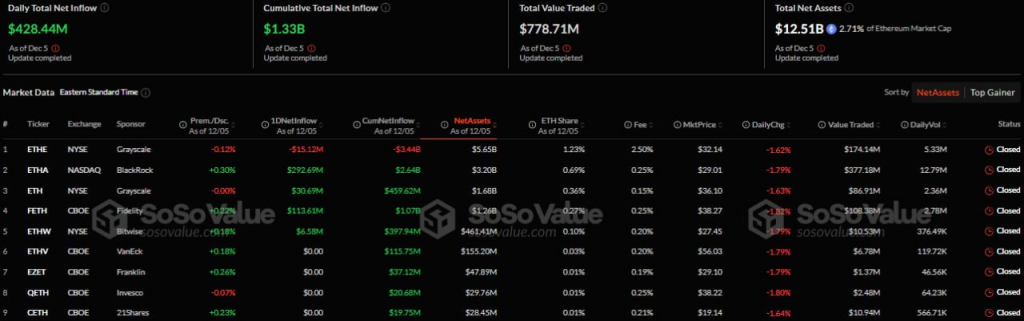

On December 5, 2024, spot Ethereum ETFs achieved a record-breaking net daily capital inflow of $428.44 million, according to SoSo Value. This milestone marks nine consecutive trading days of positive performance in the sector, with over $1.3 billion flowing into Ethereum-based products during this period.

The capital inflows were distributed among four Ethereum funds—ETHA, ETH, FETH, and ETHW—while one fund experienced an outflow and others showed no movement.

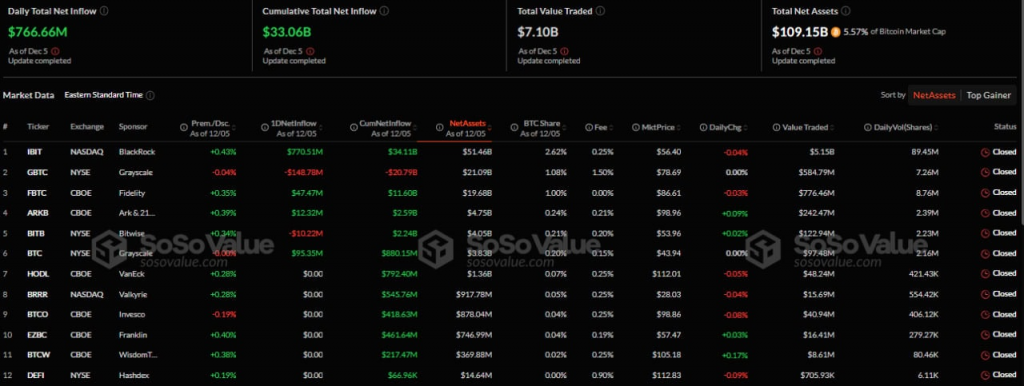

In the Bitcoin ETF sector, BlackRock’s Bitcoin ETF led with a capital inflow exceeding $770 million. Three other funds also reported positive inflows, while two experienced outflows, and the remaining products showed no capital movement.

Over the past six days, Bitcoin-based ETFs collectively attracted approximately $2.8 billion, showcasing a continued positive trend in the market.

In Hong Kong, spot Bitcoin ETFs registered an outflow of nearly 51 BTC, while Ethereum ETFs showed no significant activity.

Earlier, it was reported that BlackRock’s spot Bitcoin ETF surpassed $50 billion in assets under management, reflecting the sector’s positive momentum.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.