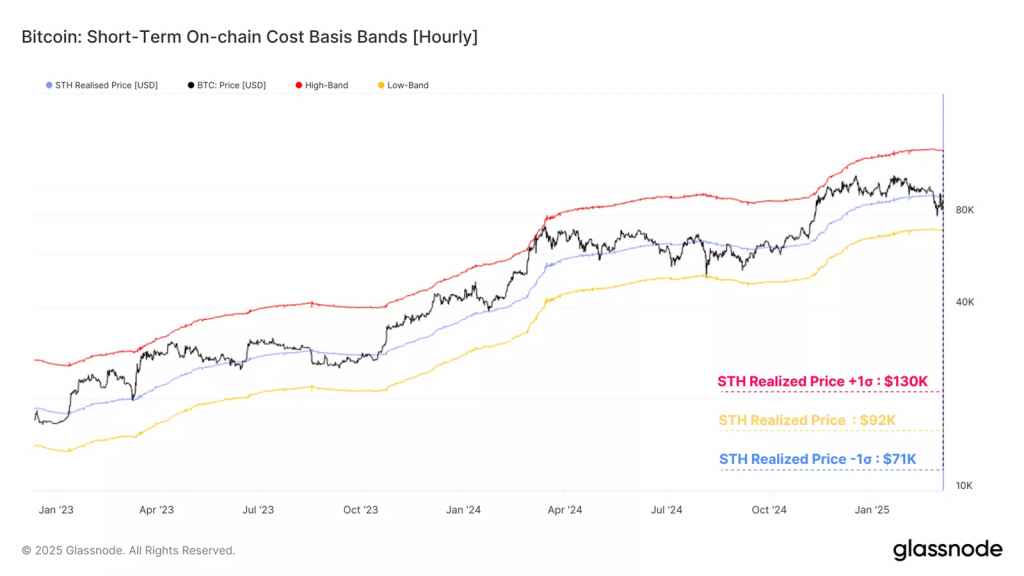

For Bitcoin, the key level to watch is $92,000, aligning with the average “break-even” price for speculative holders. According to Glassnode, failure to reclaim this level could push BTC down to $71,000.

Analysts see this zone of interest as aligning with multiple technical and on-chain metrics, including the one-standard deviation line from the average short-term purchase price.

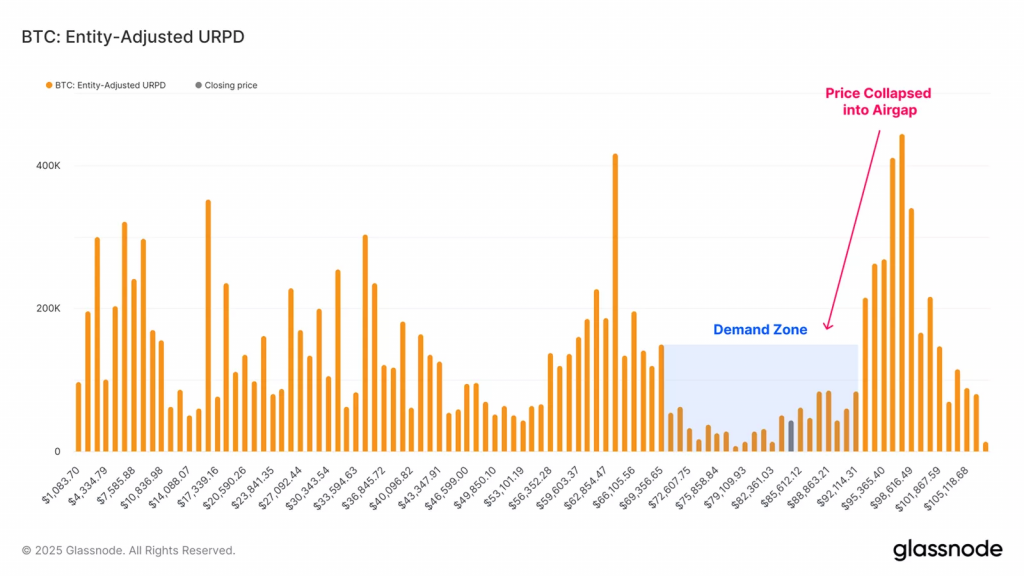

Also, between $86,000 and ~$70,000, there is an area of low trading activity based on the URPD indicator.

Experts suggest the market is testing whether bulls can sustain demand in this range. Many investors bought BTC above $90,000 and are now facing unrealized losses.

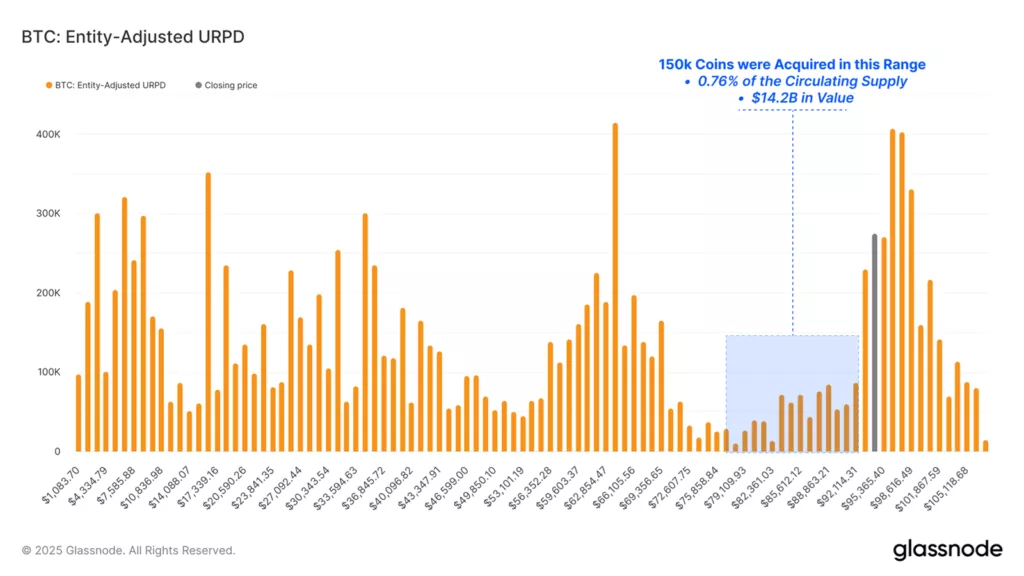

From February 26 to March 3, more than 150,000 BTC (equivalent to ~$14.2 billion) changed hands in this low-liquidity zone below $86,000.

“Prices are returning to the upper boundary of this range. It remains unclear whether investors above $90,000 will see the rally as an exit opportunity to minimize losses,” Glassnode specialists concluded.

Reminder: Former BitMEX CEO predicted BTC could drop to $70,000 if stock markets decline by 20-30% but still believes in a $1M target within the bull run.

Earlier, CryptoQuant CEO Ki Young Ju forecasted a prolonged consolidation in a broad range (e.g., $75,000-$100,000), similar to early 2024, before BTC resumes its upward trajectory.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.