Outflows from ETFs and negative market sentiment have eliminated the possibility of a Bitcoin Christmas rally. The situation might change after the expiration of options on December 27.

Asia Color – 24 Dec 24

— QCP (@QCPgroup) December 24, 2024

1/ Bitcoin’s anticipated year-end surge has fizzled. Instead, a $49.3M Mt. Gox #BTC move sparked a 14% drop, hitting 92.5k before bouncing to 95k. Liquidity’s drying up, sentiment softens, and ETFs saw their 3rd straight day of outflows. Here’s what’s…

The transfer of $49.4 million worth of Bitcoin from Mt. Gox caused a sell-off on December 23, driving the cryptocurrency’s price down to $92,500. QCP Capital acknowledged that the anticipated rally would not take place.

Market Challenges:

- ETF Outflows and Liquidity Decline: Ongoing ETF outflows and weakened liquidity are hindering a potential rally.

- MicroStrategy’s Risk Appetite Decline: Analysts noted that MicroStrategy’s purchase of 5,262 BTC for ~$561 million indicates a reduced risk appetite at current price levels.

I'm ready for the #Bitcoin santa rally! pic.twitter.com/8mbNy8rk9Y

— Mister Crypto (@misterrcrypto) December 22, 2024

Volatility Ahead:

QCP Capital forecasts heightened volatility during the New Year holidays after the options expiry on December 27.

Optimism Among Traders:

Despite dimmed chances for a rally, some traders are hopeful for a pattern similar to 2016 and 2020.

Historical Data:

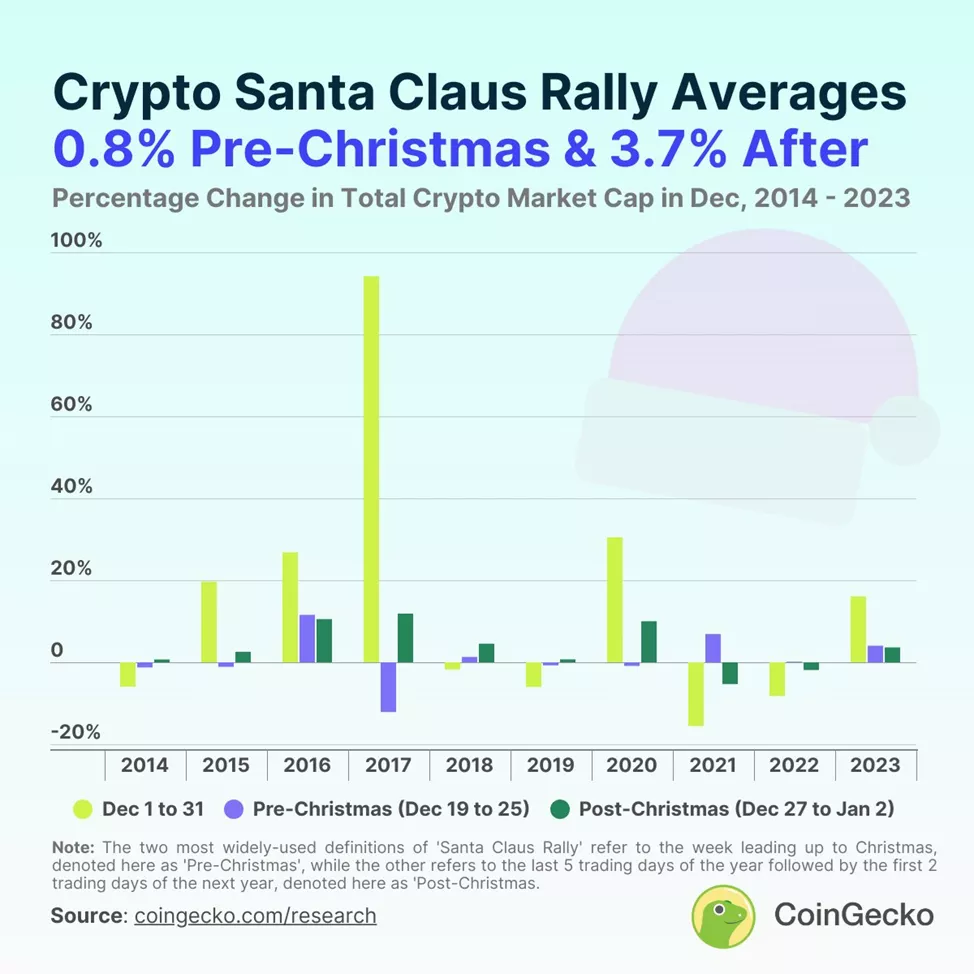

- According to CoinGecko, the crypto market has shown a Santa Claus rally in 8 out of 10 years between 2014 and 2023, with gains ranging from 0.7% to 11.8% during the period from December 27 to January 2.

- Current December losses of 2.1% are close to the median (-2.99%) but lag behind the average (4.8%), as per Coinglass.

Cautious Optimism:

Trader Titan of Crypto advised remaining calm:

#Bitcoin Most Crucial Trend Line

— Titan of Crypto (@Washigorira) December 23, 2024

As long as #BTC stays above this trend line, there’s no reason to worry.

The monthly candle may not look bullish now, but there’s still one week left before it closes. 🕒

Keep it on your radar. pic.twitter.com/VAyQFZx0G1

“The monthly candle doesn’t look bullish yet, but there’s still a week to go before it closes.”

He recommended not worrying as long as prices stay above the critical support line.

Long-Term Projections:

- Santiment: Expects a return to Bitcoin’s highs driven by increased FUD sentiment.

- Bitfinex: Projects a bull market peak in Q3-Q4 2025, targeting $200,000.

- K33 Research: Identified January 17 as the potential peak of the current rally.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.