Investment firm VanEck has filed with the U.S. Securities and Exchange Commission (SEC) to launch an exchange-traded fund (ETF) called the Onchain Economy ETF.

According to the filing, the new financial product won’t directly invest in cryptocurrencies or commodities. Instead, “at least 80% of its net assets will go to companies involved in the digital transformation and/or digital asset–based instruments.”

The fund aims to target exchanges, payment platforms, and mining firms, as well as investment products tied to virtual assets—such as futures contracts.

VanEck introduced the Onchain Economy ETF a few months after shutting down its EFUT product, which was based on Ethereum futures.

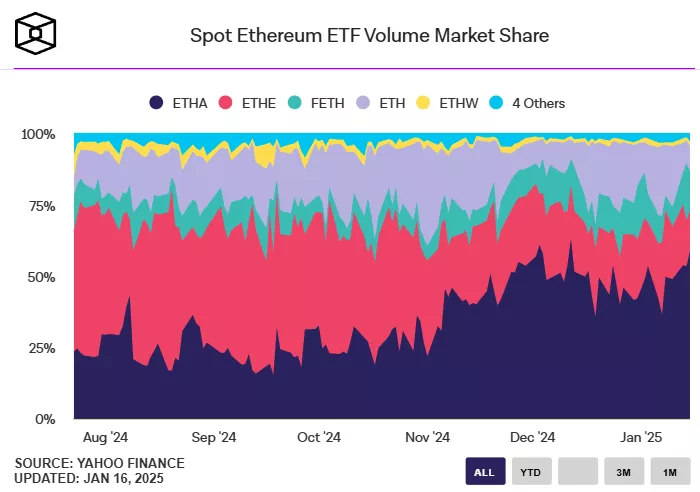

Within the segment of spot ETFs tied to Ether, the dominant players are BlackRock’s iShares Ethereum Trust ETF (ETHA) and the Grayscale Ethereum Trust ETF (ETHE):

Net inflows into Ethereum-based ETFs on January 15 amounted to $59.78 million.

Context

- In December, VanEck analysts forecasted Ether could reach $6,000 at the peak of the current bull cycle.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.