Wisconsin lawmakers proposed two bills aimed at regulating the work of cryptomats. The reason was a sharp wave of fraud in the United States.

Both documents assume that cryptomat operators will have to receive Money transfer license. Also entered Daily transaction limit of $1000 per customer and commission restriction $5 or 3% of the amount.

Before the first operation, users must pass verification, specifying the name, date of birth, address, phone number and uploading a photo of the identity card. Terminal screens will display warnings of possible fraud. Bills also provide for the possibility of returning funds to victims if they report a crime within 30 days.

If draft laws are passed, the new rules will come into force through 60 days after signing.

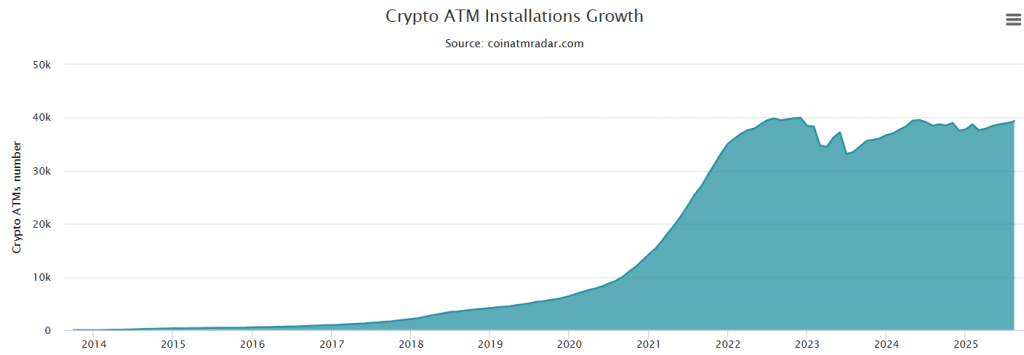

According to Fincen, in 2024, the number of complaints about fraud through cryptomata increased by 99%, and the losses reached almost $247 million (+31% to the previous year). Work in Wisconsin 582 Cryptomat, in the USA – 30 964, and around the world – 39 369 devices (Coin ATM Radar).

Experts note the importance of regulation: the founder of the crypto exchange giottus Arjun Vijay stressed that KYC’s lack of robust procedures makes cryptomats vulnerable to money laundering. Director Digital South Trust Dilip Kumar added that the new rules will increase confidence in digital currencies, although they will limit the anonymity of users.

Previously, in July, New Zealand’s Deputy Minister of Justice Nicole McKee announced plans for a complete ban on cryptomats in the country to combat money laundering.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.