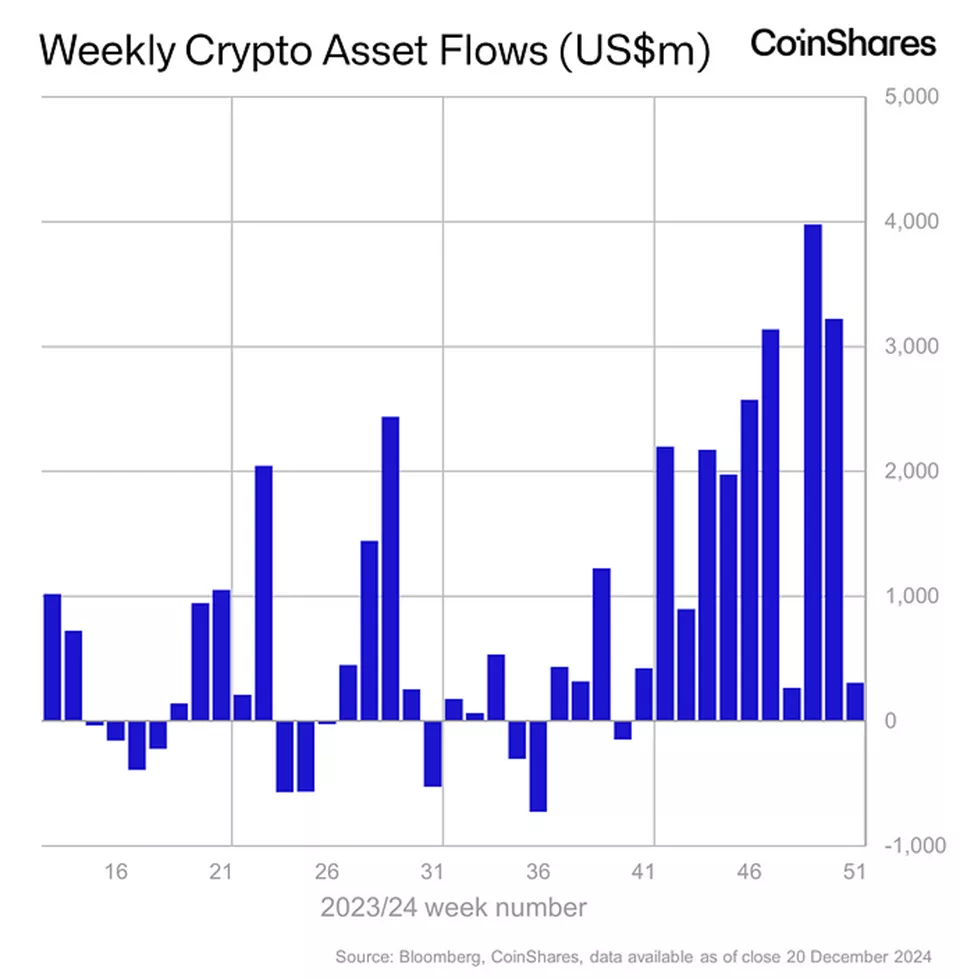

From December 15 to December 21, cryptocurrency investment funds saw inflows of $308 million, compared to $3.2 billion the previous week, according to CoinShares data.

The trend was overshadowed by the largest single-day outflow since mid-2022, amounting to $576 million on December 19, following the Federal Reserve’s “hawkish” rate cut.

At a press conference, Fed Chair Jerome Powell warned that the regulator would adopt a more cautious approach to easing monetary policy going forward.

Investors reduced positions in crypto products by nearly $1 billion over the following two days. However, the withdrawals were insufficient to offset the inflows from the preceding three days.

Year-to-date inflows reached a record $44.8 billion.

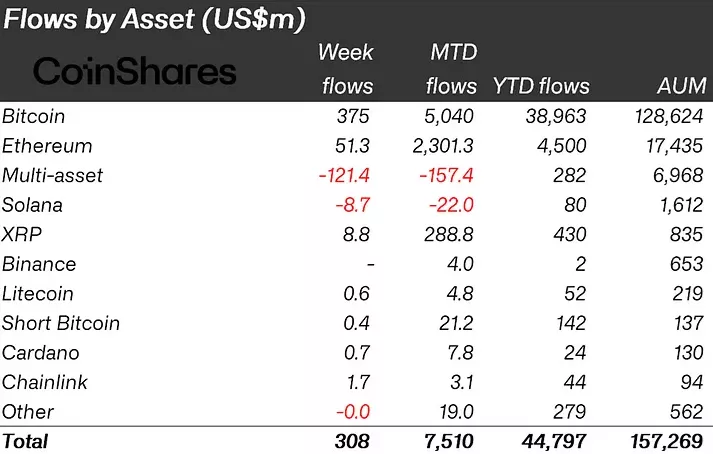

The total assets under management (AUM) in crypto funds decreased from a record $167.4 billion to $157.3 billion, amid market corrections.

Breakdown by Assets

Bitcoin-based funds attracted $274 million last week (down from $2 billion), with year-to-date inflows totaling $39 billion.

Short Bitcoin products saw modest inflows of $0.4 million, totaling $14.6 million for the year.

Ethereum funds recorded slower inflows, declining from $1.09 billion to $51.3 million, marking the eighth consecutive week of positive momentum.

XRP-related products attracted $8.8 million following record-breaking inflows of $145.8 million the previous week.

Conversely, Solana-based funds experienced outflows of $8.7 million, bringing the year’s total to $1.7 million.

Horizen and Polkadot products attracted $4.8 million and $1.9 million, respectively.

Additional Insights

Santiment forecasted a Bitcoin rebound to all-time highs due to growing FUD sentiment.

Bitfinex projected the peak of the current bull market in Q3-Q4 2025, with Bitcoin reaching $200,000—a target echoed by Bitwise.

Earlier, K33 Research highlighted a high probability of the bull run’s peak occurring on January 17.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.