The total value locked (TVL) in Berachain has grown to $3.24 billion, placing it in sixth position, surpassing Base ($3.21 billion) and Arbitrum ($2.91 billion).

Over the past seven days, Berachain’s TVL has increased by 20%, while its competitors have mostly seen negative trends.

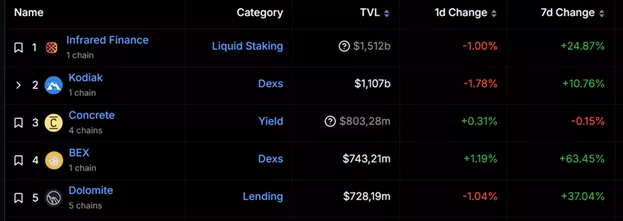

Berachain currently supports 33 protocols. The leading platform is the LST platform Infrared Finance ($1.51 billion), followed by the DEX Kodiak ($1.11 billion) and the yield aggregator Concrete ($803 million).

The native cryptocurrency of Berachain, BERA, is trading at $6.94. It ranks 115th by market capitalization, which stands at $748.6 million. Its fully diluted valuation (FDV) is $3.48 billion.

Berachain is a modular Layer 1 blockchain with EVM compatibility. It operates on the Proof-of-Liquidity consensus mechanism, a variation of Delegated Proof-of-Stake. The network utilizes three key assets: BERA for gas fees, BGT for governance, and HONEY as a stablecoin.

In April 2023, Berachain developers raised $42 million. A year later, they secured another $100 million.

Notably, the mainnet launch and BERA airdrop took place on February 6.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.