The Bitcoin market is witnessing a clash between short-term speculative holders and long-term investors, in which the latter appear to be winning, according to CryptoQuant contributor IT Tech.

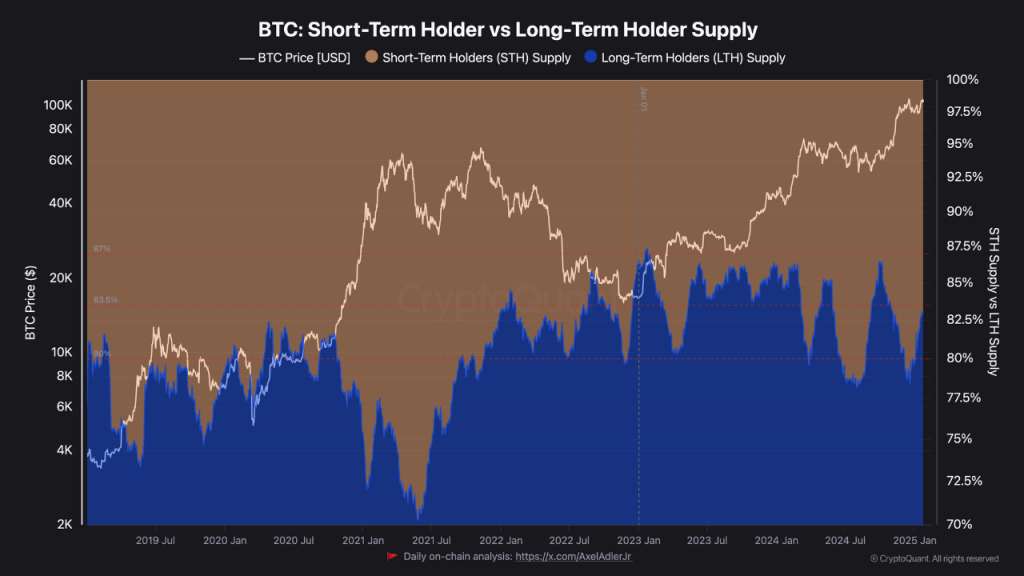

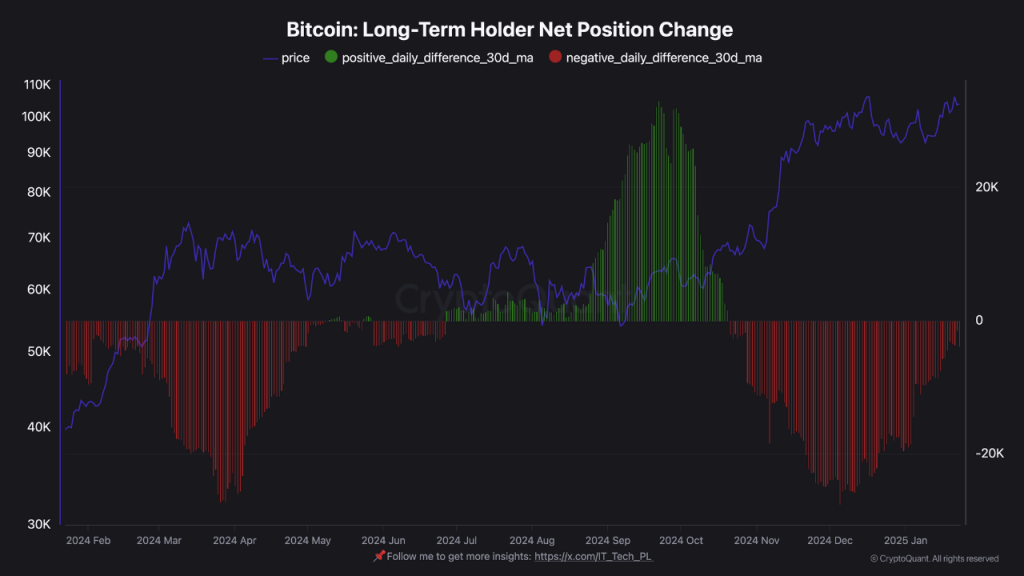

The analyst observed that long-term holders (LTH) continue to dominate the supply, indicating strong conviction in future price growth. These so-called “diamond hands” are accumulating when prices dip and strategically taking profits during rallies.

IT Tech believes that such controlled behavior underpins a bullish long-term outlook, limiting sell-side pressure.

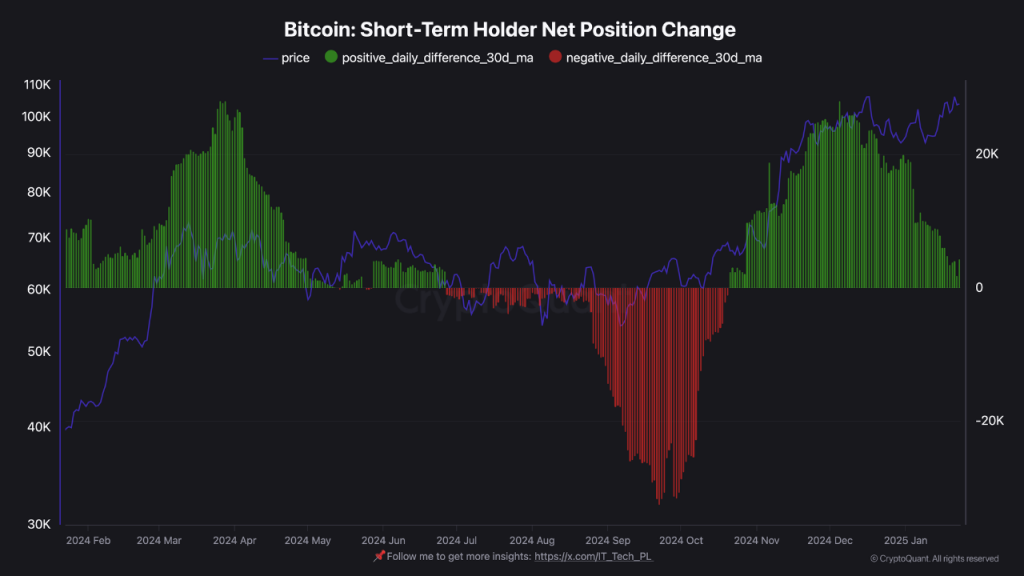

Meanwhile, short-term holders (STH) show heightened activity during price rallies, reflecting a speculative interest and fear-of-missing-out (FOMO) buys.

Significant flows during corrections point to “weak hands” exiting, causing short-lived volatility.

Given that LTH control a large portion of Bitcoin’s supply, the market appears to be “maturing,” says the analyst. A reduction in STH’s influence enhances stability, even though their speculative patterns continue to drive price fluctuations.

“The current structure—dominated by long-term holders and punctuated by short-term speculators—sets an optimistic tone for 2025. Strategic profit-taking by LTH can create healthy pullbacks, offering chances for fresh accumulation,” IT Tech concluded.

Earlier, CryptoQuant reported that, since Donald Trump’s election, large investors (whales) have supported Bitcoin. Their holdings grew from 16.2 million BTC to 16.4 million BTC, while smaller addresses decreased from 1.75 to 1.69 million BTC.

Context

- According to Glassnode, hodlers returned to accumulating Bitcoin after a major sell-off around the $100,000 level.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.