On March 9, the U.S. Federal Reserve (Fed) kept its key interest rate unchanged in the 4.25%–4.5% range.

The decision aligned with market expectations and analyst consensus forecasts.

“The Committee aims to achieve maximum employment and 2% inflation over the long term. Uncertainty about the economic outlook has increased. The Committee remains highly attentive to risks on both sides of its dual mandate,” the press release stated.

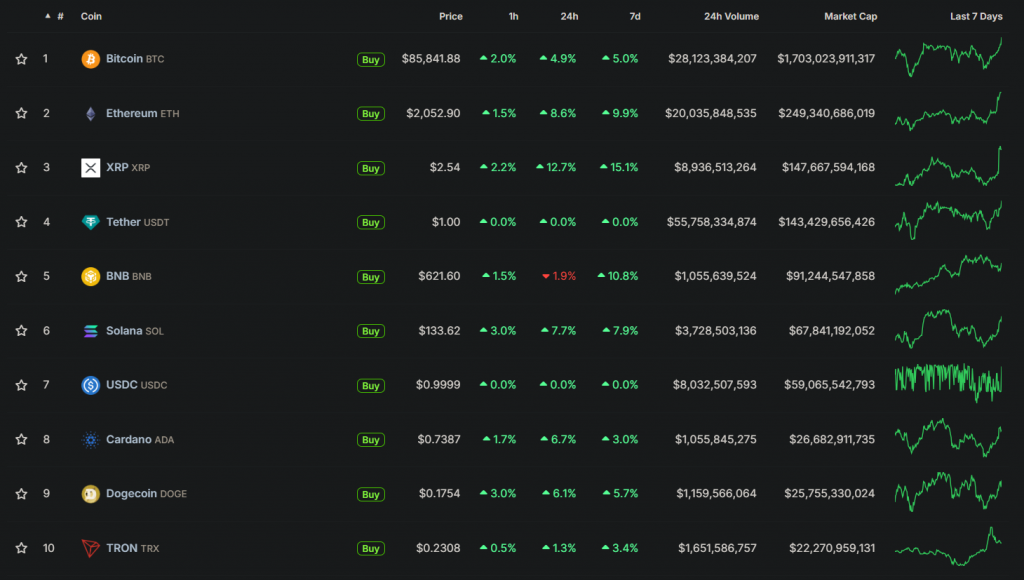

Following the Fed’s announcement, Bitcoin halted its recent uptrend. After reaching a local high of around $84,800, the leading cryptocurrency briefly dipped below $84,000 before rebounding sharply, approaching the $86,000 mark at the time of writing.

Other top-10 cryptocurrencies by market capitalization also saw gains.

“The economy remains strong and has made significant progress toward our goals over the past two years. Labor market conditions are stable, and inflation has neared our long-term 2% target, though it remains somewhat elevated,” Fed Chair Jerome Powell said at a press conference.

He added that a “significant portion” of inflation is linked to trade tariffs, but the Fed will continue analyzing data to separate tariff impacts from other factors.

“The path is clear. Quantitative tightening is nearing its end, and [Donald] Trump is going crazy over crypto. The altcoin bull cycle has begun,” said MN Trading founder Michaël van de Poppe.

In February, U.S. annual inflation stood at 2.8%, the lowest level since November.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.