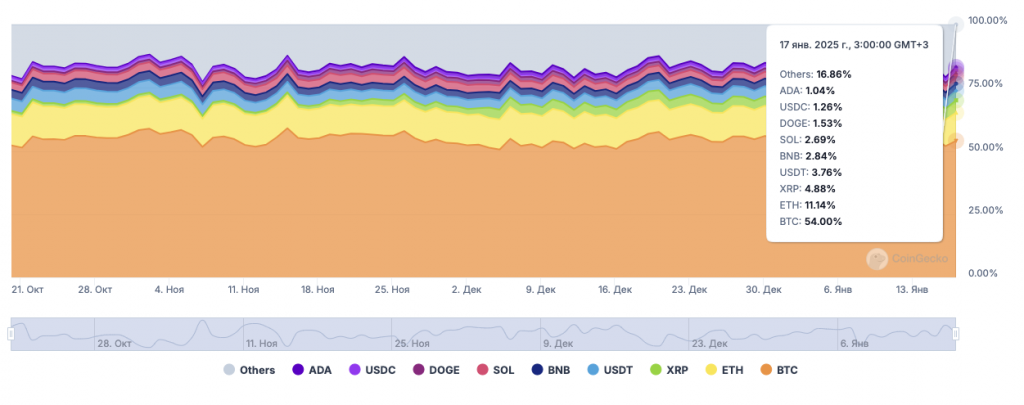

According to The Block, analysts at JPMorgan expect Bitcoin’s dominance over Ethereum and other altcoins to persist into 2025. Data from CoinGecko shows Bitcoin currently holding a 54% market share, with ETH at 11.14%.

The authors of the report highlight eight key factors that could sustain Bitcoin’s dominance.

- Inflow to ETFs

- The narrative surrounding Bitcoin as a digital hedge against devaluation continues to attract significant inflows into spot Bitcoin ETFs from both retail and institutional investors.

- Meanwhile, Ethereum-based ETFs have drawn only $2.6 billion since their launch, indicating limited demand for future altcoin-based ETFs, JPMorgan notes.

- MicroStrategy

- MicroStrategy is “only halfway through” its plan to raise $42 billion for Bitcoin purchases, analysts conclude. They add that the firm’s “21/21 Plan” provides the leading cryptocurrency with additional momentum.

- Crypto Reserves

- JPMorgan suggests that a U.S. government decision to create a crypto reserve exclusively in Bitcoin would further reinforce the asset’s position. Fidelity Digital Assets has previously forecast that not only the U.S. but other countries may adopt this approach.

- L2 Solutions

- The fourth factor is the advancement of Bitcoin Layer-2 (L2) solutions. This progress, say the analysts, poses a challenge to platforms such as Ethereum.

- Blockchains

- The fifth factor is the move of institutional blockchain applications—like digital bond trading and settlement—onto private blockchains or consortium blockchains. These offer greater privacy and customizability, making public blockchains less appealing to large institutions.

- Infrastructure Focus

- Increasingly, new projects are concentrating on building infrastructure rather than issuing tokens. According to the report, this trend differs from the token-centric strategies of the 2021–2022 bull market. The authors cite Base, which gained popularity without launching its own token, as an example.

- Long-Term Utility

- Many DeFi projects thrived early on but saw user activity and token prices dwindle once the hype faded.

- Examples like Friend.tech, Farcaster, and Lens highlight the need for more time to demonstrate real long-term utility.

- Regulatory Outlook and Consolidation

- The market is still in a consolidation phase, awaiting regulatory clarity from the new U.S. presidential administration. Analysts do not rule out a prolonged wait, given that authorities may first address other priorities.

Context

- Steno Research recently predicted Bitcoin dominance could drop to 45% in 2025.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.